On London Cabbies, Frank Stephenson, the Hyundai Santa Fe and more

From the neurology of London cabbies to the transformation of automotive lighting, from Frank Stephenson’s auto coloring book to the auto supply chain challenges, from Volkswagen’s software approach to the Honda Monkey—and more.

#hybrid

This week On Automotive

- “The Knowledge”: The Taxi Brains Project

- Lighting Beyond Lights

- From Parts to Bytes

- A Truly Creative Auto Designer

- Monkeying Around: The 2022 Honda Monkey ABS

- Only in France: The Artistry of Automotive Interiors

- 2021 Hyundai Santa Fe Hybrid

- Three Questions on Supply Chain: Talking with Cathy Fisher & Terry Onica

///

“The Knowledge”

London black cab drivers may have brains that have developed remarkable capabilities (Image: LEVC)

London drivers of black cabs have the knowhow that allows them to navigate through the city’s 58,000 streets without the use of Waze.

Because even brain scientists find this remarkable, The Spatial Cognition Group at University College London has established the Taxi Brains Project.

They are analyzing the brains of drivers via MRI scans as the drivers plan their routes.

The knowledgeable drivers have a larger hippocampus than other people generally do. The objective of the study is to help scientists develop diagnostics that will detect Alzheimer’s disease earlier, as the hippocampus shrinks early when the disease affects a person.

The black cabs are produced by LEVC, which builds the purpose-built TX electric taxi in a factory in Ansty, Coventry.

Two of the LEVC drivers who worked on the development of the electric taxi, which launched in 2018, have participated in the Taxi Brains Project.

///

Lighting Beyond Lights

Yes, headlamps are one thing. But look at the other opportunities for lighting. (Image: Marelli)

One of the biggest changes in automotive design over the past several years has been the use of LED lamps for vehicles, starting with the 2007 Audi R8.

Look at any new vehicle front end and the headlamps are technological marvels.

(The new Audi e-tron Sportback offers digital matrix LED headlamps that uses digital micromirror devices—the headlamp has a chip that contains one million of these micromirrors, each of which can be tilted up to 5,000 times per second.)

Beyond the headlamp

What caught our eye was the recent announcement that Marelli Automotive Lighting and Samvardhana Motherson Automotive Systems Group have signed an agreement to look at what they call “Smart” illuminated exterior body parts.

The parts?

Things like illuminated front grilles, bumpers, fenders, rocker panels, and rear ends.

Not only is this illumination for decorative purposes, but also. . .branding.

///

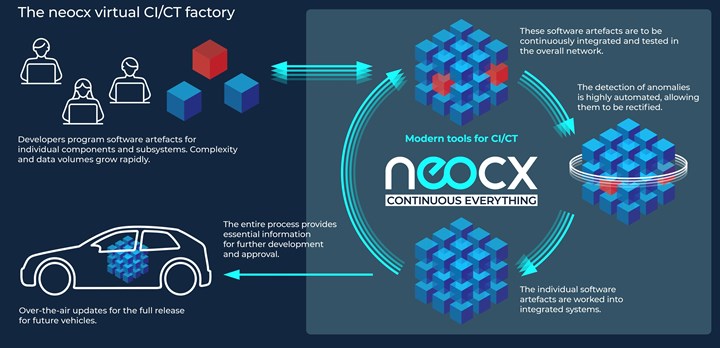

From Parts to Bytes

Volkswagen’s and TraceTronic’s approach for automated software testing and integration. (Image: Volkswagen)

One of the characteristics of the auto industry has been that it is, essentially, discrete-parts manufacturing.

A given vehicle is a collection of stampings, forgings, castings, contained assemblies, etc.

But that is a vehicle as a mechanical object.

The goal now is different.

As Thomas Ulbrich, member of the Volkswagen Board of Management with responsibility for Technical Development, puts it, “We have set ourselves the goal of evolving the car into a software-based product.”

And “making” software is a different activity than making a door panel.

So Volkswagen has established a 50-50 joint venture with a company that provides solutions for testing and integrating software, TraceTronic.

The jv is named “neocx.”

The charter of neocx is to create a continuous integration/continuous testing (CI/CT) factory.

At least a “factory” in the context of creating the development and testing tools for software modules.

The idea is to be able to integrate newly developed software components into an existing system early on and determining whether the new modules are compatible and perform as required.

What is notable about this is not only what neocx will do, but that it points to the reality that the auto industry is moving well beyond the “discrete-parts” moniker.

In addition, while the auto industry has long been characterized as being slow and methodical in relation to other industries, clearly that’s no longer the case.

///

A Truly Creative Auto Designer

Yes, this is a coloring book. (Image: Frank Stephenson Design)

After graduating from Art Center College of Design in 1986 Frank Stephenson got a position at Ford, where he contributed to the design of the Ford Escort Cosworth.

A few years later, in 1991, he moved to BMW Group in Munich, where he created the New MINI and the first-generation BMW X5.

Then in 2002, Stephenson became the first-ever design director for Ferrari and Maserati. And his contributions included the Maserati GranSport, Ferrari FXX, Maserati MC12, and the Ferrari F430.

Stephenson moved some 300 km to the west in 2006, from Maranello to Torino, where he became the design director for Fiat, Lancia, Alfa Romeo and Light Commercial Vehicles. It was then the second-generation Fiat 500 was designed.

McLaren was next on his resume, joining the legendary sports car firm as design director in 2008. While there the 720S, 570S, 675LT, PI, and MP4-12C all came to their composite glory.

In 2017 he opened Frank Stephenson Design.

So what’s the latest from this master automotive designer?

Stephenson explains, “Who doesn’t remember drawing their favourite cars as a young child? Now with this, the next generation of petrol heads can nurture their passion, channel their inner artistry and colour some of the most iconic car designs from across my career.”

Yes it includes vehicles like the Ferrari F430 and McLaren P1.

Designers are ordinarily thought of as being creative. But designers who are extraordinary come up with ideas like creating coloring books based on their storied career.

///

Monkeying Around

The Honda Monkey has an interesting backstory. (Image: Honda)

That is the 2022 Honda Monkey ABS.

Although it looks like a toy, the diminutive (wheelbase: 45 inches) miniMOTO bike is being launched with a 125-cc engine mated to a five-speed transmission. The fifth gear is said to facilitate “more comfortable cruising.”

One can imagine, say, a clown cruising on the bike.

Which is not entirely unfair.

Turns out that the original version of the bike goes back to 1961, when it was used at a Honda-owned Japanese amusement park, Tama Tech.

Tama Tech closed in 2009.

The Honda Monkey was reintroduced to the U.S. market in model year 2019.

///

Only in France

The DS 9 is going to be getting a rather unique interior. (Image: DS Automobiles)

DS Automobiles is an upscale marque within the Stellantis organization.

Thierry Metroz, DS Automobiles Design Director, says, “Since the beginning of DS Automobiles, we have been working with great craftsmen with exceptional expertise to bring French luxury to life.”

To that end, the company created a competition called DS x MÉTIERS D’ART, with the objective of working with artists and craftsmen to look at new techniques and materials for vehicle interiors.

The competition was launched in April. They have selected 10 semifinalists from which three finalists will be selected.

The finalists will be given a piece of trim from a DS 9 door panel upon which they are to apply their craft.

The winner will be announced on September 14 and provided with the opportunity to create all of the interior trim for a unique DS 9.

One of the interesting aspects of this competition is the members of the jury.

Three of the seven are Metroz and his DS Automobiles colleagues.

But here are the other four jurors:

- Pascal Morand, executive president of the Fédération de la Haute Couture et de la Mode

- Lison de Caunes, Master of art in straw marquetry

- Anna Le Corno, Cabinet maker and creative at the studio Farouche Paris

- Hubert Barrère, Artistic director of Maison Lesage and corset maker

The head of an organization for French fashion brands, a creator who works with straw, a cabinet maker, and a corset maker.

Only a French OEM would realize the artistry of fine lingerie and its potential conceptual applicability to automotive interiors.

///

2021 Hyundai Santa Fe Hybrid

Looks and capability. The Hyundai Santa Fe Hybrid. (Image: Hyundai)

There are two things that are of essential importance to any OEM when it comes to their products, two things without which even the best product will certainly under perform:

- Awareness

- Appeal

This came to mind when pulling out my bag from the hatch of the 2021 Hyundai Santa Fe Hybrid AWD in the parking garage of a hotel.

A woman was getting her luggage out of the back of an F-150 Platinum in the spot next to mine. (Yes, there was a tonneau cover on the truck box.)

“Is that the new Santa Fe?” she asked.

Which, I must confess, my respect for what Hyundai has been up to notwithstanding, absolutely floored me.

Admittedly, the Santa Fe, a midsize SUV, is the brand’s third best-selling model after the compact Tucson SUV and Elantra compact sedan. (For the first half of 2021, Tucson: 83,517; Elantra: 74,057; Santa Fe: 63,110.) So while by no means vehicularly invisible (e.g., the Nexo had first half sales of 134 so that could figure in that category), it isn’t like the vehicle is ubiquitous.

To be sure, the Santa Fe is not a new nameplate, having been introduced in 2000 and in showrooms in 2001.

Still, here was someone who saw the vehicle from an angle who immediately twigged to what it is.

- Check the Awareness box.

Then she went on to tell me how much she liked the looks of the vehicle and was thinking about getting one.

- Check the Appeal box.

When I told her it was a hybrid she was all the more intrigued. When I told her that the fuel economy is 33 mpg city/30 mpg highway/32 mpg combined (which is what I got in the real world, essentially) and that I was a little disappointed in it (e.g., the Toyota Highlander XLE hybrid returns 35/34/34 mpg), she nodded at the F-150 as if to say, “Say no more.”

- Check the Appeal box a second time.

That evening, I took one of my work colleagues to dinner in the Santa Fe. He didn’t know what it was. He was absolutely effusive about the quality of the interior and the amenities: everything from the leather seats (heated and ventilated in the front) to the crisp 10.25-inch infotainment screen to the surround view monitor that made negotiating in a cramped parking deck much easier than it would otherwise be.

Anyone who has made the drive down 75 from Detroit to Cincinnati almost ever knows that there are construction zones galore. Construction zones mean two things. (1) You are either stopped or creeping. The hybrid system is superb under such conditions. (2) You are on the accelerator when the orange cones end as is every other vehicle. The combined system output of 225 hp (178 hp produced by the 1.6-liter turbo and 59 hp from the motor) gets that done.

Looks. Capability. Quite a package.

///

Three Questions on Supply Chain: Talking with Cathy Fisher & Terry Onica

One of the most compelling challenges in the industry today is that of supply chain. The pandemic with consequences including incredible scheduling changes (lockdown then. . . no lockdown) and the lack of ready availability of semiconductors (complicated by things like a blizzard in Texas and a fire in a plant in Japan) has made it clear that no matter how good one may have thought the automotive supply chain was. . .there are still weak links.

To address the supply chain, Cathy Fisher and Terry Onica wrote a two-part e-book, Delivering on the Promise of Delivery: Preventing Future Auto Supply Chain Disruptions. Fisher is the president of Quistem, a systems-focused automotive consultancy. Onica is director of Automotive for QAD, the agile ERP supplier.

So we asked the two three questions related to supply chain. . .

1. The Problem. AIAG was founded in 1982. ERP has been around since the 1990s. MES has been around since the ‘90s. So the processes and the technologies are well established. What’s the problem?

Fisher & Onica:

There has not been full scale adoption of these technologies throughout all levels of the supply chain. OEMs and some Tier 1s have adopted these technologies, but lower-tier suppliers—especially smaller manufacturers and those who only have a small portion of their business in automotive—haven’t. Possibly this is due to the perceived costs of these technologies, which means we have not developed compelling cost/benefit evidence that would convince them to invest. However, now with an estimated $110-billion loss of revenue due to the semiconductor shortage, the industry must review its current way of thinking to find solutions, which means promoting and utilizing technologies at all levels.

In addition, we have had a work force shortage, high turnover and employees at the plant level coming in with little if any supply chain experience. Poor or lack of process in existing documentation in supply chain is causing new hires to use manual processes in order to get the job done.

2. A One-Off Unfortunate Event? OEMs canceled semiconductor orders when the plants were going down due to COVID. Microsoft and Nintendo didn’t, so the chip suppliers worked to support those customers rather than the automotive OEMs, who took themselves out of line. Then there were blizzards and fires that took out chip manufacturing capacity. So how is this a solvable supply chain issue rather than the consequence of bad guesstimates (i.e., the plant shutdowns didn’t last as long as anticipated) and unfortunate events?

Fisher & Onica:

This is a solvable supply chain issue because we have seen this problem before, and not just with semiconductors. Automotive manufacturers are not always proactive in identifying potential supply disruption risks and evaluating their impact throughout the entire supply chain. They have a tendency to focus primarily on the next immediate supply chain level and expect each subsequent tier to do the same. Supply chain professionals are often rewarded for heroics getting by getting the parts out the door as opposed to for permanently fixing the issue, which is something we’ve seen in the quality arena. With improved supply chain visibility and better scenario planning, many supply chain disruptions could be avoided or at least mitigated. However, these and other essential supply chain processes are not systematically defined and managed, especially at lower-tier suppliers. We also see many OEMs and Tier 1s not fully utilizing/trusting the technology they have available, instead performing manual analysis on Excel spreadsheets. There is a lot of manual—as opposed to automated—communication in the lower tiers of the supply chain, which causes more delays in getting the new forecast information down the entire supply chain. Manufacturers must first recognize the importance of supply chain management as a strategic, competitive advantage in their business and then utilize the full capabilities of the technology solutions that are available to better manage these risks. The automotive industry must become supply chain-focused especially as we move to the online ordering of vehicles.

3. Good Relations = Better Results? According to the 2021 Plante Moran Working Relations Index Toyota is #1 by far when it comes to supplier relations. Toyota has been least affected by the chip shortage. Is there a correlation?

Fisher & Onica

Yes, there is most likely a correlation. Consider that Toyota, closely followed by Honda, has been at the top of the WRI index for nearly a decade. You don’t maintain that kind of "winning streak" without robust, consistent systems that can adapt to changing conditions in the automotive supply chain. Toyota also took corrective actions in response to the last semiconductor shortage in 2009 and had an inventory of semiconductors available when this shortage hit. Toyota’s success likely goes beyond just communication and trust and encompasses how it engages with suppliers (early and often) to proactively identify and manage risks and potential disruptions. As an example, although there was increased communications between OEMs and their suppliers during the COVID crisis, in some cases we heard this communication was sometimes scrambled, providing mixed messages and necessitating repeated requests for analysis and information from suppliers. A number of suppliers shared with us they found these communications confusing, frustrating and a waste of time. As for the semiconductor shortage, a number of Tier 1s indicated that their OEMs are putting the blame on them and on their supplier performance reports for their production disruptions. Many more Tier 1s are now in “red supplier status” due to delivery disruptions caused by the semiconductor issue.

Get your copy of Delivering on the Promise of Delivery: Preventing Future Auto Supply Chain Disruptions by clicking on the title.

RELATED CONTENT

-

On the Genesis GV80, Acura MDX, BMW iDrive and more

From Genesis to Lamborghini, from Bosch to Acura: new automotive developments.

-

Solid Edge Brings Divergent Modeling Worlds Together

This new software suite allows the development of “beautiful models ready for production.” What more can you ask for?

-

On Electric Pickups, Flying Taxis, and Auto Industry Transformation

Ford goes for vertical integration, DENSO and Honeywell take to the skies, how suppliers feel about their customers, how vehicle customers feel about shopping, and insights from a software exec

.jpg;width=70;height=70;mode=crop)