on Honda and hydrogen, EV cost concern, IONIQ 5, inverters and an amazing Bugatti

Honda is still working hydrogen—hard. . .consumers’ concerns about the price of electricity. . .the IONIQ 5 considered. . .why ZF is collaborating with Wolfspeed on inverters. . .the Bugatti Chiron Profilée

#hybrid

Honda and Hydrogen

Honda continues to undertake the development of fuel cells for consumer vehicles as well as other applications, like construction machinery. (Image: Honda)

In 2008 I had the opportunity to drive an all-new Honda FCX Clarity in Santa Monica. The FCX Clarity is a vehicle that is powered by a 100-kW hydrogen fuel-cell stack that drives an electric motor. The vehicle—think of it as a sedan that is sized between the Civic and the Accord—has sufficient hydrogen storage to provide an EPA-certified range of 240 miles.

Back then, much was made about how the “exhaust” of fuel cell vehicles—which are actually fuel cell electric vehicles (FCEV), because instead of a battery pack providing the power to drive the motor(s), electricity comes from the hydrogen being processed by the fuel cell stack—was hydrogen and oxygen. . .as in water.

At one demonstration by another OEM—fuel cells were quite a thing prior to the Great Recession, when OEMs had to batten down the financial hatches, which meant the R&D was suboptimized while companies were trying to figure out ways to keep the lights on—a glass was held at the end of an exhaust pipe, and water slowly filled it: The engineer doing the demo drank the water.

While that seemed like nothing more than a stunt, I still distinctly recall driving behind another FCX Clarity on the Pacific Coast Highway and as the driver ahead accelerated hard, there was actually “rain” on the windshield of my car.

Yes, water exhaust.

It Continued Development

Honda pursued fuel cells. The vehicle that I drove in ’08 was followed by another model, the 2017 Clarity Fuel Cell (the “FCX” was dropped), in late 2016. (There were also plug-in hybrid and battery electric versions of the Clarity.) My most memorable moment from driving that car was going to a Shell station (pre-identified by the Honda folks) in the LA area to refuel the vehicle. It was like pumping gas—liquid gas, that is.

Know that FCEVs are not presently available from Honda. Toyota offers the Mirai. Hyundai has the Nexo.

And you’ve got to be in particular places (e.g., specific locales in southern California) to get one of those vehicles because there is not a whole lot of hydrogen infrastructure around elsewhere.

Honda has continued to work on fuel cells, though, as part of its efforts to reach carbon neutrality.

And Now

Last week in Tokyo Honda (which, incidentally, has been collaborating with GM on fuel cell technology since 2013*; the two companies even announced in January 2017 the establishment of Fuel Cell System Manufacturing LLC) announced it is taking “a proactive approach to increase the use of hydrogen as an energy carrier and strive to expand its hydrogen business.”

And as a specific deliverable: it is going to launch a FCEV vehicle next year that will be based on a CR-V with a fuel cell system it has jointly developed with GM that will have one-third the cost of the system in a MY 2019 Clarity.

According to Ryan Harty, division lead, Energy Solutions Business Div., American Honda, this vehicle will also have a plug so that it can be charged with electricity.

Looking forward, Harty says they are working on a system that will have an additional 50% cost down and a 2X durability improvement by 2030. In terms of the cost, Harty notes that it is one-sixth that of the MY 2019 vehicle’s system.

Recognizing that scale is important—not only to reduce costs but to make building out infrastructure more cost-effective—Honda also announced it will be undertaking the supply of fuel cells for stationary power equipment, construction machinery, and even space technology.

Why This Is Interesting

Honda has long been considered an engine company that wraps those engines in a variety of products, from generators to SUVs. Ryan Harty says that Honda is the world’s largest engine manufacturer (30,000,000 per year).

And while Toyota is criticized for being what is perceived by some as not sufficiently engaged in transitioning to EVs, Honda’s USP has long been internal combustion mastery (things like the aforementioned FCX Clarity notwithstanding), so it is structurally behind the curve. Toyota is recognized as having the tech to be au courant; Honda isn’t recognized as having it.

Late in January another announcement was made by Honda execs out of Tokyo about how there is a massive reorganization going on, including the creation of the “Electrification Business Development Operations.”

Clearly the company’s leadership recognizes the need to at least get on the curve.

Which brings me back to that Shell station in SoCal.

When there is an increased number of people in battery electric vehicles vying for time at recharging stations, time that is measured in a minimum of 10 minutes, being able to get a full tank of hydrogen at a gasoline-like speed is going to be exceedingly appealing.

This might just make Honda all the more relevant to the market the way its internal combustion engines long have. But this time it will be with propulision of a different nature.

:::

*GM was an early leader in developing hydrogen fuel cells. From 1998 to 2009 Lawrence Burns was GM corporate VP of R&D and Planning/Strategic Planning. He was a big proponent of fuel cells. You’ve undoubtedly heard of the “skateboard” platforms that are the underpinnings of EVs. That concept was first made widely public by Burns and his team. As he writes in Autonomy: The Quest to Build the Driverless Car—and How It Will Reshape Our World (2018), “This E-Flex Architecture had an electric motor in the front of the car, which featured electromagnets, ball bearings and a spinning axle. At the back each wheel featured wheel-hub motors, which had similar components. In the middle there was a fuel cell stack and a hydrogen storage container and a heat exchanger, which had relatively few moving parts.” Burns acknowledges in his book: “My advocacy of fuel cells, and alternative-propulsion systems overall, made me something of a curiosity in Detroit. Car guy Bob Lutz famously maintained that global warming was ‘a total crock of sh*t.’ Meanwhile, I was the rare auto executive who acknowledged climate change.” Note when Burns’ tenure at GM ended: the year the company declared bankruptcy. Focus shifted to EVs, though a comparatively small contingent of staff continued working on hydrogen. Burns was ahead of his time.

///

Electricity and EV Interest

Electrify America recently contacted its regular customers to advise them that starting in March the price charged per kWh will increase by five cents. (Image: Electrify America)

Two separate but relatable data points from Morning Consult ought to give at least a little bit of pause to those in the industry who are charging ahead toward an EV future.*

The first is something that gets little attention.

Fifty-one percent of those surveyed are “very concerned about the current and future prices” of electricity.

- Gasoline price rises garner more attention and comment personally and socially because there are large digital signs at intersections everywhere displaying the price. Electricity costs, on the other hand, are not nearly as visible.

- OEMs tout the ability to do “off-peak” charging in order to get lower rates. What happens when everyone on your street comes home from work and plugs in? According to a study published last September by Stanford researchers, if a third of the homes in a neighborhood have EVs in their garages and they are all programmed to start charging at the time when rates drop, the local grid could become unstable. What’s more, they found that if the number of EVs continues to rise Californians continue to charge at night when the rates are low, the state would need more generating capacity. When 50% of the vehicles in the Western U.S. are EVs, there would be a need for the amount of electricity (5.4 GW) equal to the capacity of five nuclear power plants.

And the second Morning Consult finding: 24% of the ~2,200 U.S. adults surveyed said they’re “not very” or “not at all” likely to buy or lease a gas-powered vehicle in the next 10 years.

The “not very” and “not at all” likely combination for EVs is 44%.

What could provide some joy for EV promoters is that those who are “somewhat” or “very” likely to buy or lease an EV in the next 10 years is also 44%.

But then there are the 67% who are “very” or “somewhat” likely to buy a gasoline powered vehicle.

(Hybrids, incidentally, are separated out. Those “not very” or “not at all” likely to get one over the next 10 years is 31%, and those who are on the pro side of the ledger represent 56%. Makes one think that Akio Toyoda is right.)

:::

*Yes, the industry will get there. But perhaps not quite as fast as the rhetorical dynamic would indicate.

///

2023 Hyundai IONIQ 5 Limited AWD

An EV that looks advanced. And it is. (Image: Hyundai)

One of the things that Ford often boasts about it that it is #2 in the U.S. market to Tesla when it comes to the sales of electric vehicles. Which is certainly true, but the delta between the two brands is absurdly enormous.

While the Mustang Mach-E and the F-150 Lightning are really well executed vehicles (I haven’t had the opportunity to get behind the wheel of the third offering in the lineup, the E-Transit), having just gotten out of the Hyundai IONIQ 5 I started wondering about how it is doing in the market compared with the Mach-E.

First let me say that from the point of view of styling—outside and in (the exterior sheet metal is sensational, arguably one of the most well-organized compact SUV forms available from any marque at any price)—the IONIQ 5 goes above and beyond: fresh, forward and futuristic without looking like an anime execution.

And while the 266-mile range of the AWD vehicle is OK, that it can charge from 10% to 80% in 18 minutes with a 350-kW charger is good. Or more to the point: with five minutes (approximately the time for a fill-up for a gasoline-powered car (but let’s remember that in five minutes you can get a full tank of gas, so even if you were driving a Dodge Durango SRT with a 392-hp HEMI V8, at a combined mpg of 15, you’d get a range of 369 miles)), the IONIQ 5 at a 350-kW charger gets about 68 miles of range in that quick(ish) stop.

However, since I am making the comparison to the Mach-E rather than to a midsize SUV muscle car, know that the Mach-E California Route 1, an AWD vehicle, has an estimated range of 312 miles. Much better.

Anyway, let’s face it, Hyundai as a brand in the U.S. is a smaller proposition than Ford, so that must be kept in mind regarding EV leadership chest thumping.

(Quick: Think of a Ford dealership nearby. Now try the same with a Hyundai dealership.)

In 2022 Ford delivered (just Ford, not including Lincoln) 1,780,978 vehicles in the U.S.

Hyundai? 724,265.

Of that enormous number of vehicles sold by Ford, there were 39,458 Mach-Es.

Of the 724,265 Hyundais, there were 22,982 IONIQ 5s.

So by looking at the overall numbers and then the numbers for the two vehicles, it is clear that the IONIQ 5 has garnered more sales on a percentage basis. (Not that this matters, necessarily, for someone who is interested in buying an EV but simply to note the IONIQ 5, unusual name notwithstanding, it a solid competitor in the space.)

Again: The Mach-E—which won the 2021 NACTOY Utility of the Year award—is a good vehicle. But categorically, the IONIQ 5 is something that should not be overlooked.

Which goes to the point that even though you may have a tougher time finding a Hyundai dealership than one with a Blue Oval out front, if you’re thinking EV, it may be well worth your while to look harder.

Some specs

- Power: 320 hp

- Battery: Lithium-ion polymer; 77.4 kWh

- Length: 182.5 inches

- Width: 74.4 inches

- Height: 63 inches

- Wheelbase: 118.1 inches

- Passenger volume: 106.5 cubic feet

- Cargo seat up: 27.2 cubic feet

- Cargo seat down: 59.3 cubic feet

- Frunk: 0.85 cubic feet

///

Wolfspeed, ZF and SiC

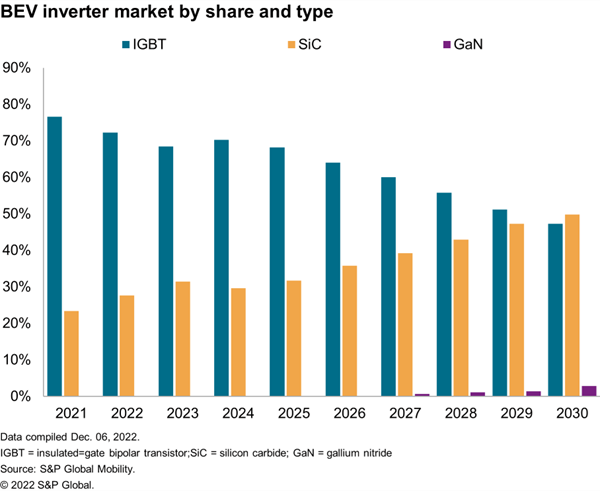

As this chart from S&P Global Mobility shows, silicon carbide is the direction inverters for electric vehicles is going. (Image: S&P Global Mobility)

Last week on a plot of real estate that includes a decommissioned coal-fired power plant in Saarland, Germany, Wolfspeed, a North Carolina-based company that produces various products based on silicon carbide and gallium nitride, announced it will build a 200-mm silicon carbide fab there.

(Yes, there could be perceived schadenfreude: coal plant giving way to factory building components for electric vehicles.)

Mobility supplier ZF announced at the same time that it is partnering with Wolfspeed and making “a significant investment” that will support what is to become the world’s largest 200-mm silicon carbide device fab.

All that sounds good. Especially if you live in Ensdorf, Germany.

Yes, but why?

But what does this mean? Why is a silicon carbide device fab at all notable?

According to researchers at S&P Global Mobility, silicon carbide (SiC) inverters for electric vehicles are more efficient and can run on higher temperatures and at a higher power output than the currently dominant insulated gate bipolar transistor (IGBT).

Which can increase EV range and efficiency.

Consequently, there is good upside for the SiC inverters.

Of course, S&P Mobility also points out that there is a tradeoff: the SiC inverters are more costly.

Still. . . .

///

The Bugatti Chiron Profilée: Production Run, One. Price, Incroyable

The Bugatti Chiron Profilée was recently produced and sold. And it is the only one of its kind. (Image: Bugatti)

While there are all manner of eye-popping valuations for vehicles that are auctioned, you’d be hard pressed to find something more amazing than a sale that occurred in Paris on February 1.

The Bugatti Chiron Profilée was put up for auction by RM Sotheby’s.

You might be thinking, “Shouldn’t that be ‘A Bugatti Chiron Profilée, not The’?”

No, there was one built. Just one from the French company.

And the car sold for 9,792,500 Euros. Or about $10.5 million.

That apparently makes it the most valuable new car ever sold at auction.

Hendrik Malinowski, Managing Director of Bugatti Automobiles:

“With just one Chiron Profilée ever set to exist, it was important for us to offer the opportunity to acquire this piece of history to as many people as possible and we were excited with the enthusiasm of the global automotive community for this very special car.”

We suspect that “as many people as possible” was probably not measured with a big number.

RELATED CONTENT

-

Revolutionary Hydrogen Storage Tank Design Could Propel H2 Deployment

Rather than storing hydrogen in a large cylindrical tank, Noble Gas has developed a conformal system

-

On The Jeep Grand Cherokee, 2022 Nissan Pathfinder, and More

An inside look at the Detroit Assembly Complex-Mack; a innovative approach to waste-free, two-tone painting; why a forging press is like an F1 car; and other automotive developments.

-

On Zeekr, the Price of EVs, and Lighting Design

About Zeekr, failure, the price of EVs, lighting design, and the exceedingly attractive Karma

.jpg;width=70;height=70;mode=crop)