on supplier relations, beneficial behaviors & customer considerations

Suppliers on their customers. . .Hyundai classic concept car. . .what to do if you supply ICE components. . .CarPlay customer considerations. . .Journey time as a service. . .Toyota flex engine line

Who Do Suppliers Like to Work With?

Once again, Toyota is the company suppliers most want to work with, according to Plante Moran’s annual survey. (Image: Toyota)

(Same as it ever was, same as it ever was)

It makes absolute sense that Plante Moran, an accounting, tax, consulting, and wealth management firm—especially that first function, given the number of numbers involved—conducts the North American Automotive OEM-Tier 1 Supplier Working Relations Index Study (WRI) because although the top lines are simple, the underlying calculations are anything but.

The study looks at how suppliers perceive their relations with Ford, GM, Honda, Nissan, Stellantis, and Toyota among eight major purchasing areas that are then categorized into 20 commodity areas.

Why is this important?

Well, according to Dave Andrea, principal in Plante Moran's Strategy and Automotive & Mobility Consulting Practice, who is instrumental in the survey and subsequent analysis, there is the non-trivial issue of OEMs being able to “adjust to industry anomalies.”*

As in pretty much all of the things that have happened since March 2020 and are still lingering. . .and which will probably take new manifestations going forward.

Good working relations with suppliers are important because they make it more likely that when those unpredicted things happen suppliers will be more responsive.

And why is that important?

Well, there is still the non-trivial matter that on average, suppliers account for the value of about 70% of a vehicle.

What’s more, Andrea points out that as the OEMs are making the transition to electric vehicles, that is challenging enough without having additional issues: “You want to have less friction,” he says, noting that another factor is the reduction of salaried staff at some OEMs, which means fewer people in purchasing, so it is beneficial for things to flow smoothly.

The Bona Fides

The survey for the 2023 WRI, conducted between mid-February and mid-April, obtained responses from 715 supplier sales professionals. They were from 459 Tier-1 suppliers. . .which represent approximately half of the annual purchases of the aforementioned OEMs.

These supplier companies are 38 of the Top 50 North American suppliers and 69 of the Top 100.

The assessments included data from 2,301 buying situations.

Plante Moran slices, dices and rices the information and categorizes it into things like Purchasing Organization Effectiveness, which itself is predicated on seven variables .. . .and there is more.

But bringing it back to the top line (with all of that foregoing underscoring the credibility):

Toyota and Honda continue in their WRI dominance as they have since 2014.

On a scale of 400 points, Toyota is at 338 and Honda 331.

GM is in third place, with 297 points—the highest score it has garnered since 2014 (previous peak: 290 in 2017).

And if there is something to be said for directionality, then know that compared to 2022 Toyota is down seven points and Honda has slipped by three, while GM is up 10.

On the Other Hand. . .

That 10-point rise is bested only by the 17 points achieved by Stellantis—but at a total score of 145, Stellantis is the lowest of the six companies. . . but then there’s Ford.

Ford, from 2022 to 2023, had a decline of 23 points. It is now at 219.

In fourth place is Nissan, at 225.

A few points that should be taken into account:

- Since 2014 Toyota has been no lower than 318, a figure that has been bested by only Honda

- In 2014 Honda was at 295 points, or two below the number GM reached in 2023. Since then, Honda’s lowest score was 310, in 2020

- Nissan was third to Toyota and Honda in 2014, when it had a score of 273. The following year it dropped to 244, then hit a nadir in 2018 at 182. Its current 225 matches its number in 2016.

- Stellantis and Nissan swapped places at the bottom of the list for the better part of the decade, although its 2021 decline to 170—which Nissan never fell to—followed by a 2022 collapse to 128 points put it at a level so low it seems anomalous

- Ford’s performance since 2014 had been the definition of middling—until 2021. That is, in 2014 it was at 267, then in the following years 261, 267, 270, 250, 262, 264—or an average of 263. But in 2021 it was down to 249, then 242 in 2022, then down to 2019. In this period, Toyota, Honda and GM have never been at that level. As noted, Toyota’s lowest is 318 and Honda’s 310. GM was at 224 in 2015 but has been no lower than 250 since.

Like Quality

In 1979 Phillip B. Crosby published Quality Is Free. The premise is simple. A company is going to make something, so it is beneficial to get it right the first time rather than having to deal with scrap, rework, recalls, etc.

By putting the systems and the mindsets in place to make getting it right the first time there is the ability to avoid all of the associated costs with getting it wrong. Thus, free.

Andrea suggests supplier relations are like quality in that it is essentially free.

But it requires, he insists, trust. Creating that has three elements, he says: (1) setting realistic expectations, (2) sharing information, (3) being accountable.

Not hard. Not costly.

But like those companies who have embraced quality, hugely beneficial.

==

*Andrea says during the COVID crisis, OEMs established “war rooms” in which people from various functions were brought together to collaborate on problem solving. There was a crisis, so this approach was taken to deal with it.

But here’s something to think about vis-à-vis the consistently good results in the WRI that Toyota and Honda get. Those companies use the Obeya, or “big room,” as part of their product development and lean manufacturing efforts. According to the Obeya Association, there are 11 principles of Obeya:

- People come together in the Obeya to respectfully see, learn & act on vital information

- People are committed to engage in continuous improvement, resolving obstacles along the way

- In the Obeya, we communicate a strong sense of purpose

- Purpose is recognizably tied to our organization strategy through meaningful objectives

- The Obeya connects strategy to execution with visible orientation on customer experience

- The Obeya meetings have a rhythm in sync with the operational heartbeat of the organization

- The Obeya visuals provide a logical and practical information

- The Obeya reflects a good understanding of the flow of work from start to delivery

- The Obeya is an attractive and available area, in proximity to the workfloor

- In the Obeya, we use analytics-drive-evidence to make business decisions

- Data owners ensure information is easy to consume, readily available, up to date, and visually attractive

While those are not supplier-specific in any way, it does underscore the importance of bringing together people from various functions to accomplish goals and achieve improvements. Regularly, not just when there is a crisis.

Maybe some OEMs would find it advantageous to dust off the books by Taiichi Ohno and Shigeo Shingo that their predecessors consulted to gain some traction in quality—and supplier relations.

///

Hyundai: Then & Now

Although this Hyundai concept was revealed in 1974, there is a certain geometric resonance to today’s designs. (Image: Hyundai)

Hyundai Motor Company was established in 1967.

In 1973 Hyundai team members traveled to Italy, looking to have a concept car created, a concept car that would be revealed at the 1974 Turin Motor Show.

The car was the Pony Coupe Concept. It was meant to introduce Hyundai to the world.

Legendary designer Giorgetto Giugiaro took the brief.

And recently, to mark the recreation of the Pony Coupe Concept, which Giugiaro participated in, he recalled:

“Hyundai approached us to start a complete redesign of a model, without much experience. I was skeptical at first because I didn’t know Hyundai Motor at that time. We were all impressed by the passion and commitment of the Hyundai engineers. They were sharp, curious, open and extremely eager to learn. They immediately embraced the working methods that were new to them. They sacrificed themselves to make a good impression — for company and their partners. I’m proud and honored to witness how this company has evolved since we first met.”

- Sharp

- Curious

- Open

- Eager to learn

Key attributes for organizational (and personal) advantage.

On the Interbrand list of the 100 Best Global Brands in 2022, Hyundai is at 35.

That’s of brands in all consumer categories.

Looked at from the perspective of just automotive brands, there are five more valuable brands (Toyota at #6, Mercedes at 8, Tesla 12, BMW 13, and Honda 26) and nine less valuable automotive brands (Audi at #46, Volkswagen 48, Ford 50, Porsche 53, Nissan 61, Ferrari 75, Kia 87, Land rover 98, and Mini 99).

Good Effort

The Pony Concept Coupe never became the Pony Production Coupe: apparently economic conditions in the late 1970s were such that the nascent OEM couldn’t bring the car to production.

Of the complete restoration, SangYup Lee, executive vp and Head of Hyundai Design Center (and no slouch in terms of design chops, having, earlier in his career, done the Cadillac Sixteen concept (2003), Buick Velite concept (2004), Corvette Stingray concept (2009), the gen-five Camaro, and the Bentley Bentayga (2015—co-designed with Luc Donckerwole, with whom he now works with at Hyundai), among others), said:

“The rebirth of the Pony Coupe Concept is a meaningful milestone in the history of Hyundai Motor because it signifies not only our beginnings but also our commitment to the future with our new dreams.”

Hyundai designers circa right now certainly seem to be sharp, curious, open, and eager to learn, too.

///

As the ICE Market Melts. . .

According to the 2023 Deloitte Global Automotive Consumer Study, 62% of U.S. vehicle buyers want a “traditional” engine under the hood of their next purchase. While that, of course, may make reaching the Biden Administration’s goal of 50% of all vehicle sales in the U.S. being electric models by 2030 troublesome, it is worth noting that in Deloitte’s 2018 survey the number was 80%. . .so if there is a similar increase in interest in the next five years, maybe 50% will be more than achievable.

One tricky bit is going to be how suppliers are going to deal with this change, as Deloitte points out, “ICE vehicles aren’t going away anytime soon,” but also calculates that the global market size for electric powertrains will be $100-billion in 2027 while it will be $70-billion for internal combustion engines.

The shift is notable: in 2022 the global market size for electric drivetrains was $29-billion and the figure for ICEs was $124-billion.

Deloitte researchers have created three categories based on an assessment of things going forward:

- Growth: Electric drivetrain, battery/fuel cell, ADAS and sensors, electronics

- Stagnant: Chassis/frame, seats, suspension, brakes, axles

- Declining: ICE, exhaust system, fuel system

And there are three actions that can be taken depending on which category a company’s business falls within:

- Expand

- Defend

- Pivot

For those in the Declining category, there are moves that can be made (e.g., “Invest in developing markets with less technological advancements”).

But even companies in the Growth category are not going to have the proverbial walk in a park.

Deloitte: “There is also a structural evolution taking place where long-standing truisms are being tested or discarded, including a volume-based business model, globally integrated supply chains, and a JIT manufacturing paradigm.”

Being a supplier has always been hard.

Seems like it may be getting harder.

///

GM, Porsche, Apple & Newton’s Third Law*

Porsche drivers want Apple CarPlay. So Porsche is providing. . . (Image: Porsche)

In early April GM announced that it won’t be using Apple CarPlay in future EVs, like the 2024 Chevrolet Blazer EV. It will be using a system it has developed with Google.

The dropped Apple-developed feature has caused a certain amount of consternation. To put it mildly.

Earlier this month Ford CEO Jim Farley told The Wall Street Journal Ford would continue to offer CarPlay (“70% of our Ford customers in the U.S. are Apple customers. Why would I go to an Apple customer and say ‘good luck’?”)

A few days later GM announced that it hired Mike Abbott, former vp of engineering for Apple’s Cloud Services, where he’ll be in charge of integrated end-to-end software.

And now this. . .

Last week Porsche announced it has added Apple Maps EV routing to its U.S. Taycan models.

Steffen Haug, managing director, Porsche Digital, “We’ve listened to our customers, and they appreciate flexibility. This integration with a product they are already familiar with gives more options and confidence in how they use their Taycan, both in day-to-day activities and on longer road trips.”

Ford brand goes head-to-head in the market with most of GM’s brands, with the exception of Cadillac. (Lincoln brand is the competitor for that.)

Presumably Cadillac would like to go head-to-head with Porsche.

Seems like the CarPlay delete is not going help Cadillac with that.

Customer preferences matter.

*For every action there is an equal and opposite reaction (simply stated).

///

Keeping Tabs on Traffic and Time

If you look closely on the left side of the image (for the cars traveling south), you can see that it would probably have been useful were some of those drivers to know things would be a bit time-consuming and for the city to have used V2X to provide some alternative routing. (Image: Yunex)

When it comes to planning a trip, knowing the routing from A to B is important.

Knowing how long it is going to take to get there is, too.

Which leads to a new acronym to know: JTaaS.

That’s for “Journey Time as a Service.”

Yunex Traffic provides JTaaS.

It has announced that it will be deploying its largest single installation of its JTaaS technology in Edinburgh, Scotland: it will be monitoring 62 corridors in the city.

In other words, these are set routes tracked rather than random As to Bs.

HERE Real-Time Traffic and HERE Routing are used by Yunex.

- The clever bit is this:

Rather than using things like cameras or even Bluetooth and WiFi sensors, things that have installation and maintenance costs, to say nothing of requiring months to implement, the Yunex Traffic setup can be configured in a matter of minutes.

It uses information from vehicles as well as other devices that are part of the traffic infrastructure that are used for reasons other than setting up the Stratos software.

Municipalities using the JTaaS system can monitor vehicle flow, information that can be useful for traffic management.

Drivers can get a realistic prediction of their travel time. Municipalities can make adjustments to traffic patterns based on what’s happening on the ground.

Gino Ferru, HERE Technologies svp and general manager, EMEA:

“Managing traffic more sustainability is one of the key mobility challenges of our time. Journey Time as a Service is a great example for how data-driven solutions can make traffic flow more efficiently, allow for municipalities to anticipate congestion to offer alternative routes in a timely fashion, and inform drivers about expected journey times.”

At present, there are >200 corridors in the U.K. and Ireland that are being monitored by the JTaaS system.

(Yunex Traffic? Until mid-’22 it was part of Siemens Mobility.)

///

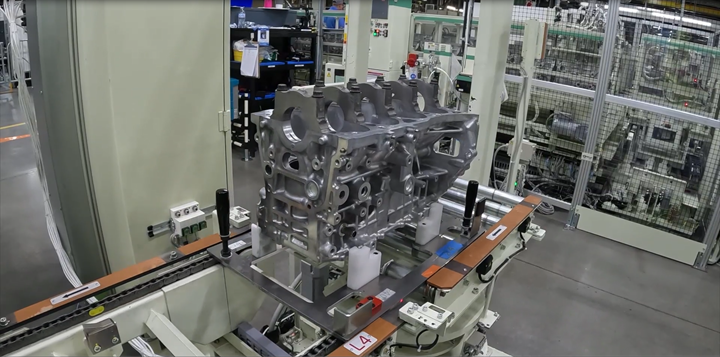

Toyota’s New Flex Engine Line Launched

Toyota is operating a new engine production line capable of producing three different engines. Demand-based production. (Image: Toyota)

Last week Toyota launched a new engine manufacturing line at its production complex in Georgetown, Kentucky.

The line—which represents a $145-million investment—is unlike any other the OEM has in North America: It is capable of producing three different engines:

- Two different 2.4-liter turbos (one for FWD applications, one for RWD)

- A 2.5-liter

All of the engines are capable of being used for Toyota and Lexus hybrids.

Mark Klee, head of powertrain at Toyota Kentucky:

“With this exclusive new flexible line beginning production, we continue delivering products that meet customers preferences and needs.”

Note:

While Toyota is being chastised by some for not being sufficiently aggressive in providing full EV offerings, it is being rewarded in the market for its electrified—as in hybrid—offerings.

In Q1 2023 Toyota and Lexus hybrids racked up sales of 116,285 units—cars, crossovers and trucks.

For example, there were 20,927 Toyota Highlander Hybrids delivered in Q1.

One model that competes with the Highlander is the Chevy Traverse.

Chevy delivered 31,533 Traverses in Q1, none of which are hybrids (it comes with a 3.6-liter V6).

Which means the Highlander Hybrid sales were about 2/3 of the Traverse total sales.

The all-in number of Highlander sales in Q1 was 55,344. So that’s 38% who chose the hybrid model.

And if we take the total number of hybrids sold by Toyota in Q1, the 116,285, it is considerably more than the combined number of Buicks (38,138) and Cadillacs (36,321) sold in the same period.

Seems that customer preference matters.

Note 2:

According to the U.S. Department of Energy, a hybrid vehicle has annual “CO2 Equivalent” emissions of 6,898 pounds. Full gasoline-powered vehicles: 12.594 pounds.

EVs are zero, right?

No.

2,817 pounds, according to the DOE. This is predicated on the sources of electricity used to charge the vehicle.

From an emissions point of view, while the hybrid may not be ideal, it certainly isn’t as heinous as its sometimes made out to be.

]]]

RELATED CONTENT

-

Ford Simulates Gravity

Although virtual development tools are being used more and more, there are still some things that are done in the real world.

-

On Zeekr, the Price of EVs, and Lighting Design

About Zeekr, failure, the price of EVs, lighting design, and the exceedingly attractive Karma

-

When Automated Production Turning is the Low-Cost Option

For the right parts, or families of parts, an automated CNC turning cell is simply the least expensive way to produce high-quality parts. Here’s why.

.jpg;width=70;height=70;mode=crop)