on Lynk & Co, avant-garde EV concept & a defense of increments

About a Netflix approach to vehicles. . .a Formula E-inspired luxury coupe. . .an Audi factory tour. . . Ford’s go-fast strategy. . .a production outlook. . .U.K.’s sinking numbers. . .parking for dollars (actually pounds). . .Ram’s EV development

Something to Know About Lynk & Co

The Lynk & Co 01: Membership matters. (Image: Lynk & Co)

Although Lynk & Co is a European phenomenon for the moment, it is worth paying attention to what the company is doing because it could portend what could happen elsewhere.

Although it is arguably an OEM, rather than focusing on selling vehicles, it is based on a membership model.

Members can get a Lynk & Co 01, a hybrid, for €500 per month. That’s good for 1,250 km (it is €0,15 per km beyond that) and includes maintenance, insurance and road tax.

And this is something that the demographic the company is focusing on can absolutely understand:

“Members can continue or cancel the membership at the end of each month, much like Spotify or Netflix, depending on their lifestyle needs.”

What’s more, the company has developed an app that facilitates owners of the 01—yes, the vehicles are available for purchase—sharing their cars with other people.

Here’s the reason why Lynk & Co will have trouble gaining traction in the U.S.:

“It also offers a direct-to-consumer approach, nullifying costly dealership intermediaries.”

Franchise laws in the U.S. are such that “dealership intermediaries” are fixtures in transactions of a vehicular nature (although Tesla is putting that to the test in plenty of places, and other new manufacturers are likely to follow suit).

In Europe there are, as of the end of 2021, 59,539 members. (It operates in Belgium, France, Germany, Italy, the Netherlands and Sweden.) Which is about 50,000 more than the company’s target for the first full year.

Here’s the thing

The company is addressing the vehicle market like the aforementioned Netflix and Spotify: Many younger people can’t understand why someone would buy a physical artifact (e.g., an album) or why they can’t have something on their own schedule (e.g., why wait for a movie at a particular time: stream it when you’re interested).

And it also established clubs (in Amsterdam, Gothenburg, Antwerp, Berlin, Stockholm, Hamburg, and Munich) where events are held for members (and probably those who may be thinking about joining).

This isn’t a transaction like buying or leasing a vehicle. It is about joining a community of like-minded people.

At this point there are some of you who are pooh-poohing this whole thing.

But there is something you should know

Lynk & Co is under the Geely Automotive umbrella. Geely owns brands including Volvo, Lotus, Polestar, and Proton. Li Shufu, who heads Geely, is the second largest individual owner (9.68%) of Mercedes-Benz.

This isn’t a company that is likely just taking a flyer on Lynk & Co. Geely has considerable bandwidth and it is using it.

///

Three Things About Bosch’s Big Numbers

Electromobility is playing a large role in Bosch’s business. (Image: Bosch)

The Bosch Group reported 2021 sales of €78.8 billion, which is above pre-pandemic levels.

EBIT from operations was €3.2 billion, an increase of more than half, so it is expected the EBIT margin from operations will be about 4%.

A serious improvement.

Some takeaway quotes from Dr. Stefan Hartung, chairman of the Bosch board of management:

- “We were able to exceed our forecasts despite many challenges, such as cost burdens due to supply bottlenecks and price increases for raw materials.” Bosch had the same problems most companies have.

- “Climate action is driving our business forward—from mobility solutions and industrial automation to building technology and home appliances.” Bosch is committed to the EU Green Deal. Obviously, there is financial benefit for those who are developing and making the products of tomorrow today.

- “We are generating billions in sales with electromobility.” For those who have any doubt about the viability of the electrification of the fleet, think about that.

///

La voiture électrique

One imagines that’s not an ideal place to drive an EV concept, but it does look cool. (Image: DS)

“Our objective is to apply the experience acquired in Formula E and the expertise that we’ve taken from our international titles to a project which predicts the high-performance electric car of tomorrow. It is a laboratory that we will use to analyse the behaviour of components and to develop them with a view to future manufacturing. The idea is also to find solutions to lower costs, make them easier to manufacture and explore implementations in production models. The next generations of the E-TENSE range will benefit from these developments.”—Thomas Chevaucher, DS PERFORMANCE Director

Or said another way: that vehicle shown in the photo, developed by DS Automobiles, a brand within the Stellantis portfolio, is a cool concept car that they’re rationalizing via the “laboratory” moniker.

Although it is a real car that will undergo track testing.

DS is an interesting brand in that it started as a subbrand within Citroën, with “DS” variants of vehicles being premium models. It had something of a coming-out party at the 2015 Geneva Motor Show as its own brand, a premium marque.

DS participates in the FIA Formula E series via DS Techeetah, so that’s where the experience in that arena comes from.

About that Car

It is named the DS E-TENSE PERFORMANCE.

The body is a carbon fiber monocoque. It, like the powertrain, are adapted from Formula E.

The powertrain consists of a 250-kW motor at the front and a 350-kW motor at the rear. The battery is sourced from Saft, a subsidiary of TotalEnergies, a French energy company.

Last September Stellantis, Mercedes-Benz and TotalEnergies announced that the three of them would be working together in Automotive Cells Company (ACC). ACC is dedicated to the development of EV battery cells and modules. An objective is to have “at least” 120 GWh cell capacity by 2030. (DS plans to introduce only EVs by 2030. Coincidence?)

So the powertrain may be the only “real thing” in the DS E-TENSE PERFORMANCE.

Up Front

Well, that’s not entirely true. Apparently the front end, which was influenced by the DS AERO SPORT LOUNGE (that use of capital letters is tiring), a concept EV introduced in February 2020. It seems that the area previously used as a grille becomes a place for a lighting setup announcing the brand like a “shop window.” So that approach will undoubtedly make it to production vehicles.

And Unreal

Yes, while this is a real one-off vehicle, DS is also offering it in NFT form.

Of course.

///

How to Build an Audi EV

Inside the Audi factory in Brussels. (Image: Audi)

Speaking of electric vehicles (production models, this time). . .

Once, plant tours were fairly common, but they’ve pretty much fallen by the wayside because (1) OEMs became more focused on production operations and weren’t particularly interested in some guy who wandered off the shuttle into the midst of the work causing disruption and (2) for the past couple years there has been that deadly virus that has required OEMs to become even more focused on the health of their associates without the distraction of that guy wandering anywhere.

Ford, working with The Henry Ford (which most of us in southeastern Michigan simply refer to as “Greenfield Village,” even if we’re talking about the Henry Ford Museum), has established the Ford Rouge Factory Tour, which includes a walking tour of sections of the plant where F-150s are built.

But if you want to (a) see electric vehicles being built (b) in another country, then you’ll want to check out https://www.audi.stream/en and navigate to the section “Audi at the Brussels location - under the sign of e-mobility.”

The first four minutes or so are a setup of Audi, but then it is in Audi Brussels and the production of the e-tron and the e-tron Sport models.

Having had more than my share of plant tours, whether as an industrial tourist or journalist, I can say that this nearly 18 minute video is worth watching whether you’re an industry professional or would just like to show your kids how EVs are built.

///

What’s Wrong With Increments?

Ford’s Farley is putting the proverbial pedal to the metal. (Image: Ford)

“We’re done with incremental change. “We have a clear plan, a bias for action, and a whatever-it-takes mindset.”

That’s Jim Farley, Ford president and CEO, during an earnings call on February 3, 2022. The company reported a full-year net income of $17.9-billion for 2021.

Then, as Bloomberg reported shortly thereafter: “Ford Motor Co. shares tumbled the most in almost two years after the automaker missed estimates for quarterly earnings and cautioned it may get off to a slow start to the year due to supply chain issues.”

While stock prices are certainly important (and let’s face it: by the time you read this they will be different from what they were last Thursday at the end of trading), and while Farley, in the announcement of Ford’s results said, “Financial performance is obviously critical”—that “We’re done with incremental change” mindset is potentially troubling.

Farley said, “We’re also proud that customers see how Ford is taking EVs mainstream and have already ordered or reserved more than 275,000 all-electric Mustang Mach-E SUVs, F-150 Lightning pickups and E-Transit commercial vehicles – and we’re breaking constraints to deliver every one of them as fast as we can.”

The Eli Goldratt gloss notwithstanding, there are some things worth knowing.

The Numbers

Last year Ford delivered 27,140 Mustang Mach-Es.

Laudable, but it should be noted that it also sold 52,414 regular Mustangs.

The F-150 Lightning will undoubtedly be a success—but know that last year Ford sold 726,004 F-Series trucks powered by liquid fuel and it will have the capability to build 150,000-electron-powered versions by mid-2023.

And as of the end of January it had more than 10,000 orders (including some 1,100 from Walmart) for E-Transits.

Last year Ford delivered 99,745 non-E Transits.

The Toyota Way

Farley’s quoted comments sound bold.

But as a guy who spent time at Toyota (he joined the company in 1990 and left for Ford in 2007), Farley needs to take something he knows well called “continuous improvement” into account.

Consider: in December 2012, according to goodcarbadcar.net, Ford’s U.S. market share was 16.8%. Toyota was at 14.3%.

According to Kelley Blue Book, Ford ended 2021 with a U.S. market share of 12.6%.

Toyota finished at 15.5%.

That means Toyota even outperformed the perennial leader, General Motors, which finished at 14.6% in 2021,

Rather than taking a victory lap, when the numbers were reported, Jack Hollis, Toyota North America’s senior vice president of automotive operations, said during a conference call, “Yes, we did surpass General Motors in sales.

“But to be clear, that is not our goal, nor do we see it as sustainable.”

Clearly a different mindset.

One more thing.

Ford boasts that it is the number-two seller of electric vehicles in the U.S., a position Farley describes as “an important early step toward eventually being the true EV leader.”

At least there is that qualification (“eventually”).

But. . .

When Ford sold 27,140 electric Mach-Es in 2021 and Tesla sold 352,471 electric vehicles in the U.S. in 2021. So while the second-place claim is accurate, it really seems a bit much for so comparatively little.

While a bias for action is laudable in an industry long known for anything but, when developing and executing new complex systems, there is a little more than something to be said for a methodological mindset.

///

Get Back

The Model 3. Tesla continues to build and build and build and. . . (Image: Tesla)

The issue is the recovery. As in when will OEMs get back to where they belong?

LMC Automotive did some reckoning on the subject. The firm considered global light vehicle production. The year 2019 was used as the base. The last “normal” year.

Whatever an OEM produced in 2019 is considered 100. Then the calculation LMC made is how many global OEMs are or will be at 100 or more going forward from 2019.

There are 15 OEMs considered (BMW, Daimler, Ford, Geely, GM, Honda, Hyundai, Mazda, Renault-Nissan-Mitsubishi, SAIC, Stellantis, Suzuki, Tesla, Toyota, VW).

In 2020 there was one OEM that was >100.

No surprise: Tesla.

Surprise: 140. A big gain over 2019.

But there’s more.

For 2021 LMC found two companies surpassed 100: SAIC at 111 and Tesla at 255.

Things will likely improve this year with BMW anticipated to be at 103 and Geely at 103, too. SAIC and Tesla are there, 107 and 363, respectively.

In 2023 there are only four companies that haven’t bested their 2019, the projection has it. Ford at 94, GM at 88, Honda at 95, Renault-Nissan-Mitsubishi at 93, and VW at 95.

By 2025 there are just three companies that are expected to be still below 2019:

- Ford at 97

- GM at 91

- Honda at 99

Presumably, this is, well, strategy.

(Thanks to LMC’s Bill Rinna for a bit of clarification.)

///

Building in the U.K., 2021 (Ouch)

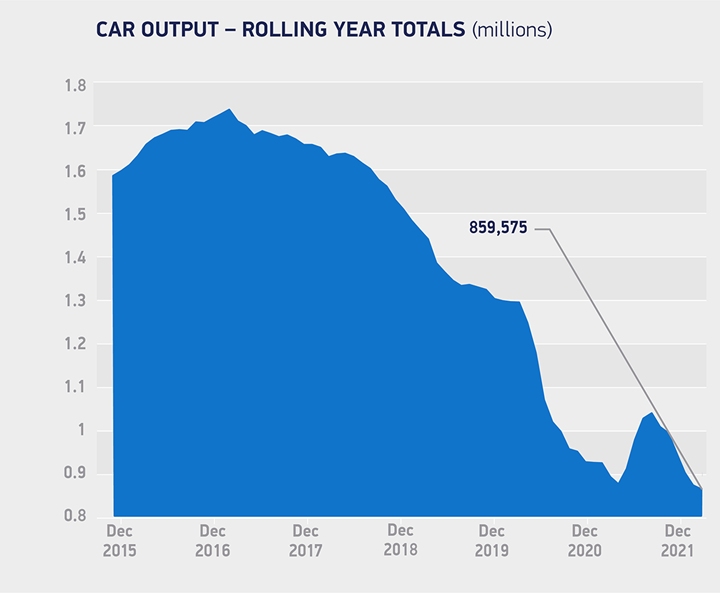

That chart of U.K. production is hard to look at. (Image: SMMT)

On the subject of somewhat more dour numbers. . .

That chart is absolutely shocking. U.K. car production fell 6.7% in 2021 to 859,575 units, or 61,353 fewer vehicles than in 2020. The 2021 numbers were down 34% from 2019.

The 2021 number is particularly notable because it hasn’t been that low since. . .1956.

One interesting aspect of U.K. vehicle production is that the vast majority of the build is exported. Of the 859,575 vehicles, 705,826 were shipped to overseas markets. (That number was off 5.8%.)

Heigh ho, silver lining

“2021 was another incredibly difficult year for U.K. car manufacturing, one of the worst since the Second World War, which lays bare the exposure of the sector to structural and, especially, Covid-related impacts. Despite this miserable year, there is optimism.”—Mike Hawes, chief executive, Society of Motor Manufacturers and Traders (SMMT)

For one thing, he says that “Brexit uncertainty is largely overcome” now, so that’s a positive.

And even within that 859,575 there’s something good(sih):

Battery electric vehicle production increased 72%. Hybrid builds were up 16.4%.

So electrified vehicles were 26.1% of vehicle production in the U.K. last year (224,011.)

If that’s the future, then the U.K. will be prepared for it.

///

Parking Some Extra Income

Brits with an available parking spot at their homes can rent it out and generate a bit of extra dosh. (Image: YourParkingSpace.co.uk)

Speaking of the UK. . .

“Rocketing food and energy prices have left many to take stock of how they can make their income stretch that little bit further.

“Often, this involves tightening the purse strings on dining out, leisure or entertainment expenses.”

Harrison Woods, CEO of a UK-based company, just doesn’t point to the situation but delivers another solution that adds to the purse:

“By renting out an empty driveway, homeowners can make up any deficit without making any significant lifestyle changes.”

That’s right. Rent your driveway. Make some cash.

Woods runs YourParkingSpace.co.uk.

According to the company, in 2021 “savvy homeowners” managed to take in an average £500 annually. Yes, renting out their driveways.

(Woods’ company handles the logistics and billing for individuals, as it does for large firms.)

For some reason, a driveway in Bristol (just over 2 hours west of London via the M4) brought its owner £33,100.

That must be some driveway.

///

If You Can’t Be First . . .

Ram is developing the structure; its customers will help with the rest of the Ram 1500 BEV. (Image: Ram)

Ford has started builds of its battery electric pickup, the F-150 Lightning.

Chevy has announced the Silverado EV, which is scheduled to go rolling out of Factory ZERO and into dealers’ lots in the spring of 2023.

What about Ram?

Well, although they may be late to the party, they may be stylishly, beneficially tardy.

Earlier this week the brand, which became a standalone in 2009 (and led to the somewhat confusing “Ram Ram” with the same word for brand and vehicle), announced:

Ram Revolution

Which is a campaign to communicate with potential Ram 1500 BEV owners both physically and digitally.

Mike Koval Jr., Ram Brand CEO–Stellantis:

“Our new Ram Revolution campaign will allow us to engage with consumers in a close and personal way, so we can a gather meaningful feedback, understand their wants and needs and address their concerns--ultimately allowing us to deliver the best electric pickup truck on the market with the Ram 1500 BEV.”

Clever Clinics

Yes, OEMs conduct customer clinics. (Some might argue too many of them.)

This is taking that customer querying to a new level.

Consider: While pickups are pickups and consequently familiar, electric pickups are new, and still will be in 2024, when the Ram 1500 BEV is planned to launch.

So by performing this engagement not only will the potential customers learn about electric vehicles, but the designers and engineers at Stellantis will achieve an understanding of what these people might want.

If you aren’t first, you’ve got to be better.

And this seems to be the strategy at Ram.

RELATED CONTENT

-

On Military Trucks, Euro Car Sales, Mazda Drops and More

Did you know Mack is making military dump trucks from commercial vehicles or that Ford tied with Daimler in Euro vehicle sales or the Mazda6 is soon to be a thing of the past or Alexa can be more readily integrated or about Honda’s new EV strategy? All that and more are found here.

-

Global Supply of Automotive Fasteners from a Single Source

PennEngineering offers a global supply for a wide range of fasteners for the automotive industry, including China-based facilities that manufacture standard and custom products to world-class standards of quality at lower cost.

-

Choosing the Right Fasteners for Automotive

PennEngineering makes hundreds of different fasteners for the automotive industry with standard and custom products as well as automated assembly solutions. Discover how they’re used and how to select the right one. (Sponsored Content)

.jpg;width=70;height=70;mode=crop)