Electrification, ADAS Drive Semiconductor Growth

Demand expected to jump more than 75% by 2026

Getty Images

In June, IHS Markit forecasted the global automotive semiconductor market would plunge 20% this year in the wake of the coronavirus and related economic downturn.

The outlook has improved considerably since then.

In its latest analysis, IHS now predicts semiconductor revenue will contract 9.6% to just over $38 billion for the year.

What Happened?

Global vehicle sales have rebounded in the second half of the year. As a result, IHS has increased its 2020 forecast by about 6% since June to 72 million vehicles.

But that’s only part of the story.

The sharper turnaround for automotive semiconductors is attributed to a higher percentage of electrified vehicles, according to the forecasting firm.

This is due in large part to government stimulus packages to boost sales specifically for such vehicles after COVID restrictions were eased. The strategy differs from the “cash-for-clunkers” initiatives employed after the 2009 financial crisis to get older vehicles off the road, which tended to favor small, inexpensive models with relatively little electronic content.

Source: IHS

Value Added

Hybrids and full electric vehicles tend to have significantly higher semiconductor content than models powered by stand-alone piston engines, with software controls for battery systems, traction motor inverters, DC/DC converters, AC/DC chargers and air conditioning converters.

Despite the overall market slowdown, IHS says, semiconductor revenue for electrified propulsion systems will jump nearly 23% this year to $2.7 billion.

By comparison, the company expects a 20% decline for semiconductors used in conventional engine and transmission systems.

Driver Assist

Electrified vehicles also tend to have more electronic features—including high-end infotainment units, user interfaces and advanced driver-assist systems—than their ICE counterparts, says Phil Amsrud, IHS’s senior analyst for automotive semiconductors. He says this is true even in the small-car market.

“It was a revelation for us after looking at the data,” Amsrud says, noting that it’s much easier to add content to a high-voltage battery architecture. “You have a lot more flexibility than with a traditional ICE vehicle and wiring harnesses, where it can be a struggle to add electronic devices.”

He describes the transition to ADAS and semi-autonomous features as a “virtual circle.” New sensors require more powerful controllers, which in turn enable even more sensors and other electronic content.

What’s Next?

IHS forecasts light vehicle sales volume will rebound to 81 million vehicles next year, with electrified models continuing to take a larger share of the market.

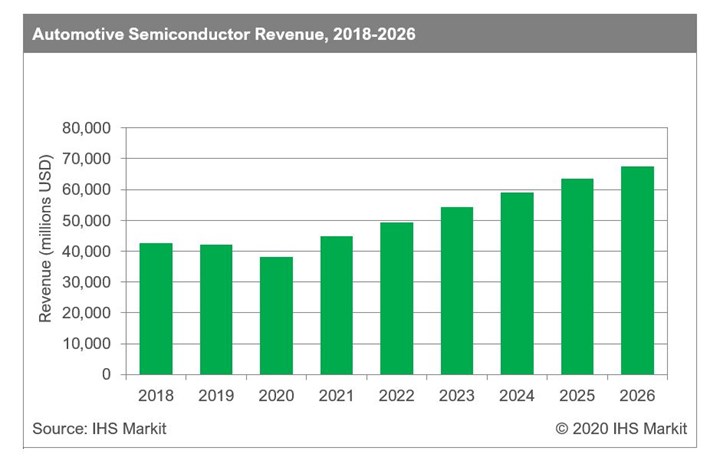

The company predicts automotive semiconductor revenues will jump 18% in 2021 to $44.9 billion. This will be followed by annual increases of about 7% to reach $67.6 billion by 2026.

To support electric propulsion systems and new features, vehicles also are expected to adopt new electronics architectures and increasingly integrate dozens of individual electronic control units into a handful of more powerful domain control systems. This will open the door for even more electronics content, Amsrud says.

RELATED CONTENT

-

TRW Multi-Axis Acceleration Sensors Developed

Admittedly, this appears to be nothing more than a plastic molded part with an inserted bolt-shaped metal component.

-

Things to Know About Cam Grinding

By James Gaffney, Product Engineer, Precision Grinding and Patrick D. Redington, Manager, Precision Grinding Business Unit, Norton Company (Worcester, MA)

-

On Automotive: An All Electric Edition

A look at electric vehicle-related developments, from new products to recycling old batteries.