Real Fed Funds Rate Remains Unchanged for Third Month

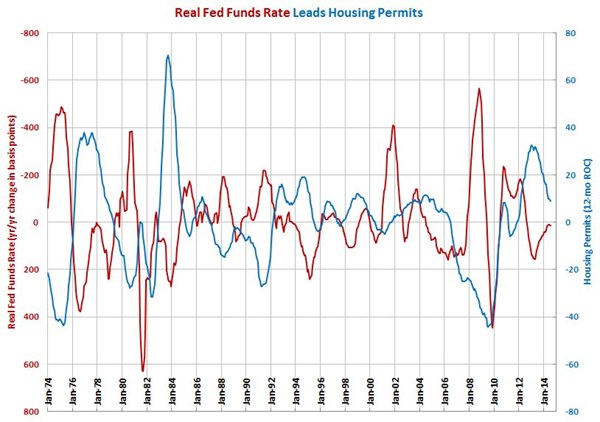

While the rate itself is virtually unchanged, the year-over-year change in the rate increased for the second month in a row.

#economics

The real Fed Funds rate was -1.47% in July 2014. This is the lowest the real rate has been since September 2013, but the rate was just 0.01% (or 1 basis point) lower than last month. This is the fourth month in a row that the real rate has slowly fallen. However, the real rate has fluctuated in a very narrow band since September 2013 and has not changed significantly since April 2013.

The year-over-year change in the Fed funds rate ticked up for the second month in a row. As the nominal rate is virtually zero, the reason the year-over-change has to started to rise is because the annual rate of inflation has fallen the last two months. However, the rate of inflation is still close to 2.0%, and official inflation has been higher the last four months than at any time since earl 2012.

If the nominal Fed funds rate stays where it is currently and the rate of inflation remains at roughly 2% (it's been slightly higher than that the last two months), then the change in the real Fed funds rate will move lower until March 2015. At that time, it will begin increasing again. This indicates that the annual rate of change in housing permits and consumer durable goods spending should bottom out very soon. Then, the falling year-over-year change in the Fed funds rate should provide support for accelerating growth in housing permits and consumer durable goods spending through the first quarter of 2016 based on the historical correlation between these data points.

However, the Federal Reserve has hinted at rate hikes coming earlier than most people believe. This could just be talk, but if the Fed funds rate starts rising it will the positive effect of lower rates through next spring. Also, the Fed has stated that it is going to end quantitative easing, which could cause interest rates to rise.

The real Fed funds rate is an important leading indicator for the following industries: appliances; automotive; custom processors; furniture manufacturing; hardware; HVAC; metalcutting job shops; off-road/construction machinery; petrochemical processors; plastics/rubber; pumps/valves/plumbing products; textiles/clothing/leather goods; and wood/paper.

RELATED CONTENT

-

Ford’s $42 Billion Cash Cow

F-Series pickups generate about 30% of the carmaker’s revenue. The tally is about twice as much as what McDonald’s pulls in.

-

On Lincoln-Shinola, Euro EV Sales, Engineered Carbon, and more

On a Lincoln-Shinola concept, Euro EV sales, engineered carbon for fuel cells, a thermal sensor for ADAS, battery analytics, and measuring vehicle performance in use with big data

-

Enterprise Edges into Self-Driving Car Market

U.S. rental car giant Enterprise Holdings Inc. is the latest company to venture into the world of self-driving vehicles.

.JPG;width=70;height=70;mode=crop)