We provide media solutions to industrial manufacturing markets

We Help You Build Brand + Increase Business

Learn MoreInsights on Industrial Manufacturing

Manufacturing Marketer Newsletter

Key news and information

delivered directly to your inbox!

SUBSCRIBE NOW

An Audience of Influencers

Reach manufacturing buying teams throughout the entire industrial purchasing process

350,000

Qualified Print Subscribers

25,000,000

Unique Website Visits

425,000

Email Subscribers

150,000

Event Registrants

120,000

Social Followers

Media & Marketing Solutions

Proven avenues in today's economic landscape to drive sales, make lasting connections and expand your business

COLLECTIONS

DIGITAL-DEMOS

RETARGETING

ADVERTISING

SOLUTIONS

ANALYTICS

CONTENT

PRESENTATIONS

GEN

Let's Talk!

Design your custom media and marketing program

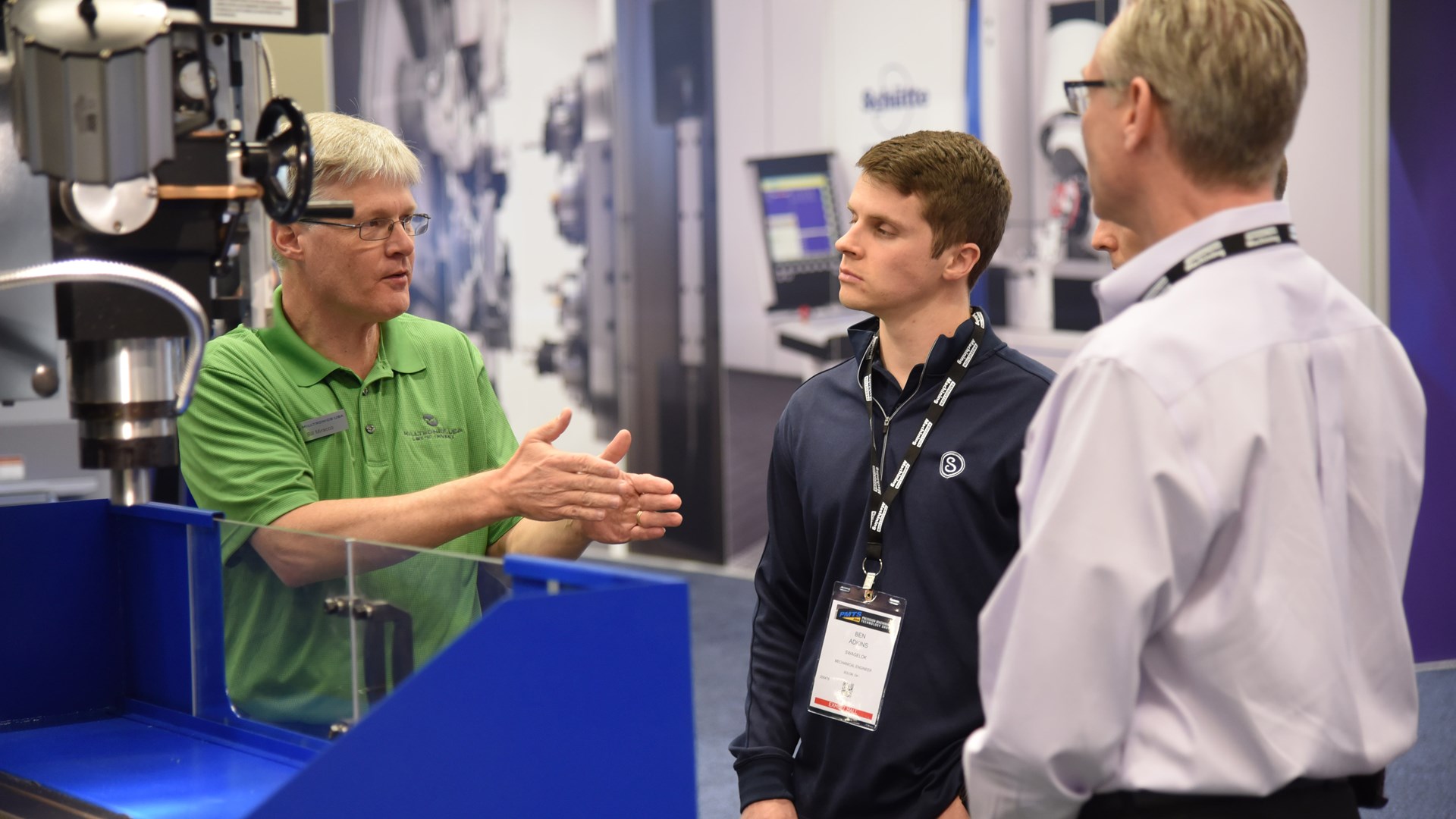

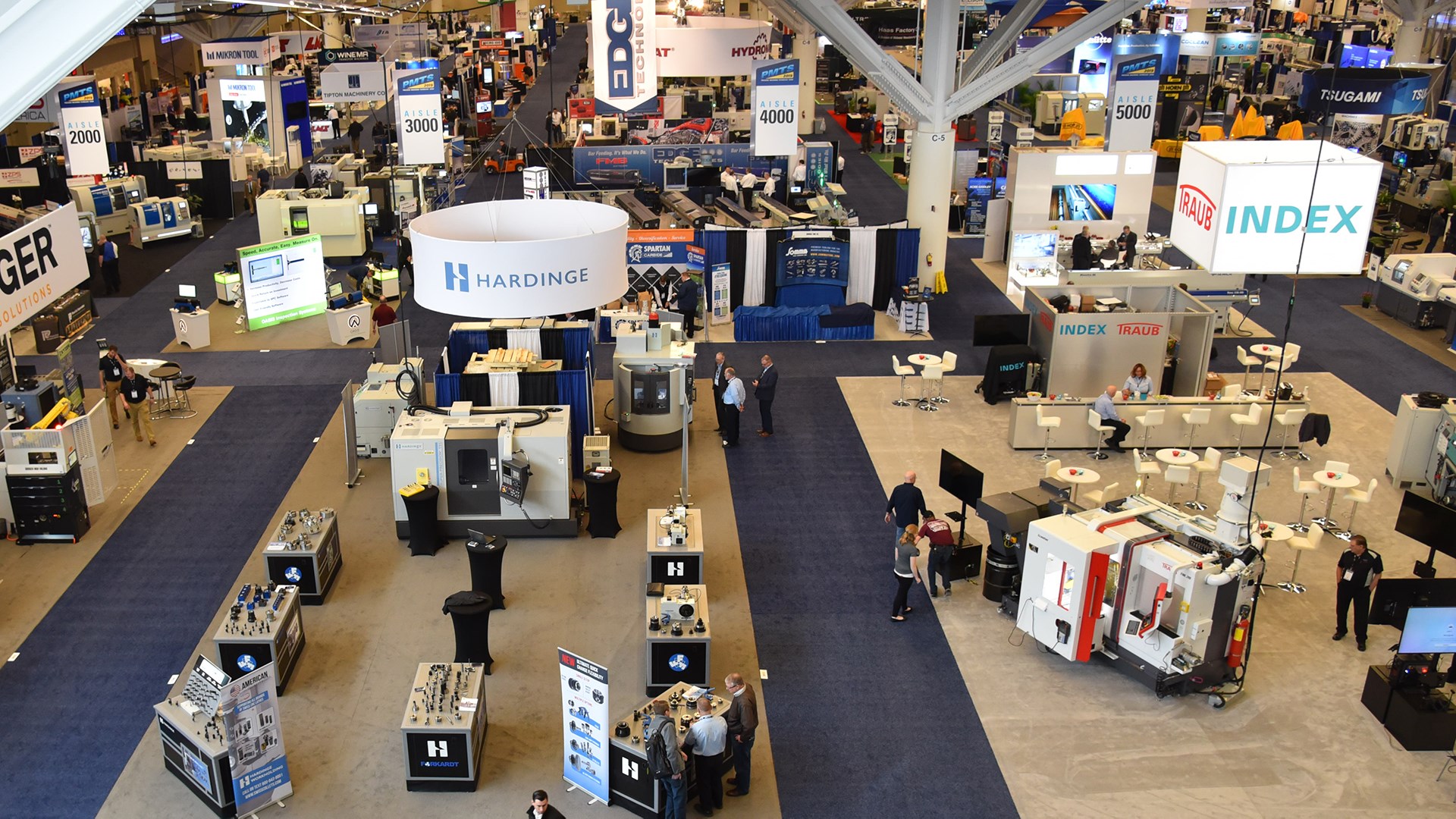

Contact UsIndustry Events that Connect

Buyers and sellers alike rely on Gardner Business Media to provide the best atmosphere for networking and learning about new technologies, products and services

Learn More"Gardner has been an outstanding strategic partner of Royal Products for over 50 years. Between their very knowledgeable team, wide range of marketing vehicles, and consultative (never pushy) approach, Gardner has been instrumental not only in producing a steady flow of solid leads, but in elevating the Royal Products brand in the eyes of leading industry professionals."

Tom Sheridan, President, Royal Products