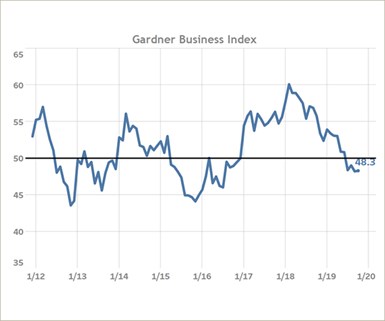

October Sees Moderate Contraction, but Growing New Orders

The GBI for October was 48.3, signaling a fourth month of mildly contracting business activity across the U.S. manufacturing sector. However, total new orders continue to do well. Based on a three-month moving average, the best performing end-market as of October was aerospace, followed by medical equipment manufacturing. The market for construction machinery continued to experience the fastest rate of contracting business activity, mirrored by a similarly enduring contraction in the industrial motors market.

#economics

RELATED CONTENT

-

Mazda, CARB and PSA North America: Car Talk

The Center for Automotive Research (CAR) Management Briefing Seminars, an annual event, was held last week in Traverse City, Michigan.

-

On Urban Transport, the Jeep Grand Wagoneer, Lamborghini and more

Why electric pods may be the future of urban transport, the amazing Jeep Grand Wagoneer, Lamborghini is a green pioneer, LMC on capacity utilization, an aluminum study gives the nod to. . .aluminum, and why McLaren is working with TUMI.

-

Inside Ford

On this edition of “Autoline After Hours” Joann Muller, Detroit bureau chief for Forbes, provides insights into what she’s learned about Ford, insights that are amplified on the show by our other panelists, Stephanie Brinley, principal analyst at IHS Markit who specializes in the auto industry, and Todd Lassa, Detroit Bureau Chief for Automobile.