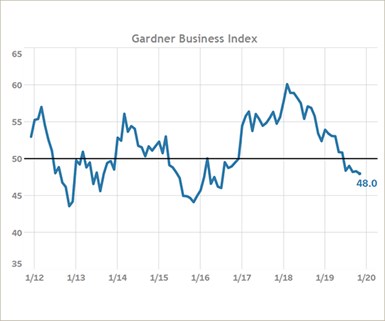

November Gardner Business Index (GBI) Accelerates Contraction

The Gardner Business Index (GBI): November marks only the second time in 2019 that shops with more than 250 employees have reported an overall contraction in business activity. Prior to the July 2019 reading which fell just below 50, the last time that large firms reported contracting conditions was during the third quarter of 2016.

#economics

RELATED CONTENT

-

On The German Auto Industry

A look at several things that are going on in the German auto industry—from new vehicles to stamping to building electric vehicles.

-

VW Warns of Higher Costs to Develop EVs

CEO Herbert Diess says the €20 billion ($23 billion) Volkswagen AG has budgeted to electrify its entire vehicle lineup won’t be enough to meet that goal.

-

on the Genesis GV60 interior, EV sales in H1, Bentley Bentayga's wood work, Faurecia's advanced manufacturing & more

The strange glowing orb in the Genesis GV60. . .global EV sales in the first half. . .creating wood for the Bentayga interior. . .the importance of material handling at Faurecia. . .lux ATPs. . .fast Porsche. . .fast Lambo. . .the Avalon Hybrid. . .Silverado steel. . .