C-19 Slams Manufacturing Technology Market

There haven’t been numbers like these since the Great Depression. But there is some daylight

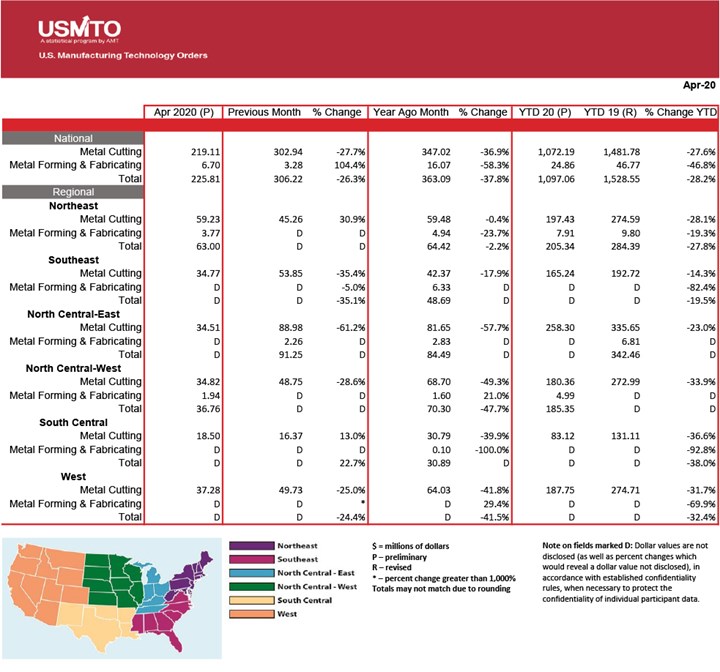

According to AMT—The Association For Manufacturing Technology, April manufacturing technology sales were down 26% from March and 39% lower than they were in April 2019. At $225.8 million, that is the lowest monthly figure since May 2010.

Douglas K. Woods, AMT president, said, “Data confirms that U.S. industrial production dropped lower than during even the Great Depression.”

However, not all is depressing.

“The aerospace and automotive sectors have begun retooling and are placing orders for new equipment to ramp up production in the fall.”

Woods said that they’re seeing some delays in ordering, “but we are not seeing any cancellations; in fact, April cancellations were lower than the 2019 average.”

Oxford Economics data, Woods said, estimates that there will be a year-over-year decline of 50% for machine tool orders in 2020—but, again a bright(er) spot—“they have also forecast a robust 84-plus percent increase in MT orders in 2021.”

Still, even that ~84% boost will still be a 10% decline compared with pre-pandemic numbers.

(Image: AMT)

An Observation

It is a bit interesting that there is growth in purchasing in aerospace—well, maybe SpaceX is rejuvenating interest in rockets because the airline industry certainly isn’t buying a whole lot of aircraft anytime soon. And while U.S. auto sales are projected to be on the order of from 14.5 to 16.4 million, with the size of the decline is all that remains to be determined, there is still some aggressive retooling going on as several OEMs make a transition from cars to crossovers and increase the electrification quotient in their vehicles, both of which call for new capital equipment.

.jpg;width=70;height=70;mode=crop)