December Gardner Business Index Shows Improved Business for Larger Firms

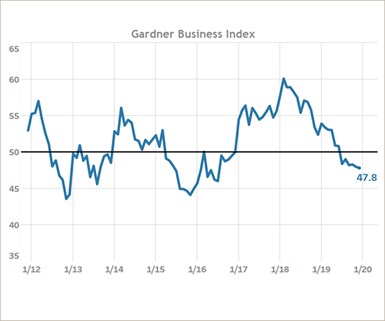

While the Gardner Business Index ended 2019 with a year low reading of 47.8, certain sectors of the manufacturing industry continue to impress; one must simply know where to look. Gardner Intelligence’s review of the underlying data for the month observed that the Index – calculated as an average of its components – was lifted by expanding activity in supplier deliveries and modestly contracting activity in new orders, employment and exports. The Index was pulled lower by production and backlog readings which reported quickening contraction. Among the over 20 end markets tracked by Gardner, five stood out during 2019.

#economics

RELATED CONTENT

-

Report Forecasts Huge Economic Upside for Self-Driving EVs

Widespread adoption of autonomous electric vehicles could provide $800 billion in annual social and economic benefits in the U.S. by 2050, according to a new report.

-

Inside Ford

On this edition of “Autoline After Hours” Joann Muller, Detroit bureau chief for Forbes, provides insights into what she’s learned about Ford, insights that are amplified on the show by our other panelists, Stephanie Brinley, principal analyst at IHS Markit who specializes in the auto industry, and Todd Lassa, Detroit Bureau Chief for Automobile.

-

On Lincoln-Shinola, Euro EV Sales, Engineered Carbon, and more

On a Lincoln-Shinola concept, Euro EV sales, engineered carbon for fuel cells, a thermal sensor for ADAS, battery analytics, and measuring vehicle performance in use with big data