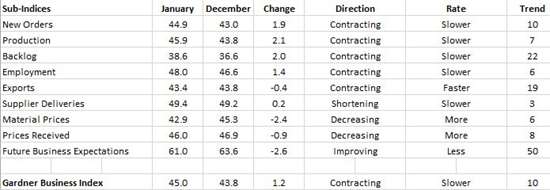

GBI for January: 45.0

The index generally has trended up the last three months and in January reached its highest level since July 2015.

#economics

With a reading of 45.0, the Gardner Business Index showed that durable goods manufacturing industry contracted for the 10th month in a row. But, the index generally has trended up the last three months and in January reached its highest level since July 2015.

New orders contracted for the 10th consecutive month, but the rate of contraction has decelerated significantly the last three months. Production continued to contract, but it too has improved the last three months. Although, it has not improved as much as the new orders index. The backlog index continued to contract. However, it improved for the second month in a row and seemed to break out the downward trend it had been on since March 2014. The index still indicated falling capacity utilization over the next six months at least. Employment contracted for the sixth month, and the index was nearly at its lowest level since the survey began in December 2011. Exports remained mired in contraction due to the strength of the dollar. Supplier deliveries shortened for the third month in a row, indicating that there was slack in the supply chain.

Material prices plunged for the sixth month in a row. This reflects the decline in commodity prices worldwide because of slower global growth. Prices received decreased for the eighth consecutive month. The decline in prices received has not been as steep as the decline in material prices though. Future business expectations weakened from the last month, falling to their lowest level since December 2012.

All plant sizes contracted for the first time since August 2015. Plants with more than 250 employees contracted for the second month in a row. Facilities with 100-249 employees moved back into contraction after just one month of growth. Facilities with 50-99 employees contracted for the sixth month. Companies with 20-49 employees contracted for the 10th month in a row. The rate of contraction has been more significant the last four months. Companies with 1-19 employees continued to contract but had their highest index since July 2015.

The Southeast was the only region to grow in January. It has been the best performing region for three months in a row. The North Central-East, Northeast, West, and North Central-West all contracted at a similar rate. The index for the South Central was below 40 for the sixth consecutive month.

A number of industries expanded in January, quite a few more than much of 2015. Off-road/construction machinery grew at the fastest rate with an index of 59.5. It was followed by primary metals, petrochemical processors, plastics/rubber products, medical, hardware, electronics/computers/telecommunications, and industrial motors/hydraulics/mechanical components. All other industries contracted. From slowest to fastest contraction, they were machinery/equipment, other manufacturing, automotive, aerospace, custom processors, metalcutting job shops, pumps/valves/plumbing products, forming/fabricating (non-auto), power generation, military, and oil/gas-field/mining machinery.

In addition to the overall durable goods index, we compute indices for a number of technologies or processes. All technologies contracted for the seventh month in a row. From slowest to fastest contraction, the technologies were plastics, finishing, metalworking, composites, precision machining, and moldmaking.

Planned capital expenditures for the next 12 months remained below their historical average, but they were at their second highest level since August 2015. Compared with one year ago they contracted 14.1 percent, which was the slowest rate of contraction since February 2015.

RELATED CONTENT

-

On Urban Transport, the Jeep Grand Wagoneer, Lamborghini and more

Why electric pods may be the future of urban transport, the amazing Jeep Grand Wagoneer, Lamborghini is a green pioneer, LMC on capacity utilization, an aluminum study gives the nod to. . .aluminum, and why McLaren is working with TUMI.

-

On Quantum Navigation, EVs, Auto Industry Sales and more

Sandia’s quantum navi, three things about EVs, transporting iron ore in an EV during the winter, going underwater in an EV (OK, it is a sub), state of the UK auto industry (sad), why the Big Three likes Big Vehicles, and the future of logistics.

-

Auto vs. Tech: Guess Who Wins

Matthew Simoncini, president and CEO of Lear Corp., provided some fairly compelling figures this week at the CAR Management Briefing Seminars that show just how out-of-whack the valuations of tech companies are vis-à-vis auto companies.

.JPG;width=70;height=70;mode=crop)