COVID Exacerbates Supplier/OEM Relations

Improved communications and other best practices advocated

Trust. Communications. Long-term commitment.

These are the cornerstones of good relationships. And they’re the ones that are tested the most during a crisis.

Strained Relations

(Image: Plante Moran)

Suppliers discovered this the hard way during the global pandemic, according to Plante Moran’s WRI (Working Relationship Index) Pulse survey.

Respondents reported stressed OEM relationships across the board this year. But they also came armed with suggestions on how to improve the situation.

The Survey

Some 265 supplier executives responded to the survey, which was conducted between Nov. 16 and Dec. 4.

Serving as a mid-term report between Plante Moran’s annual WRI surveys, the new study assessed how the coronavirus has impacted industry relationships. Respondents were asked to rate their customer experiences (covering 653 buying situations) pre- and post-shutdown this year.

The Bad

Trust, commitment to long-term viability and effective contract structures throughout the North American supply chain all have weakened in the wake of COVID-19.

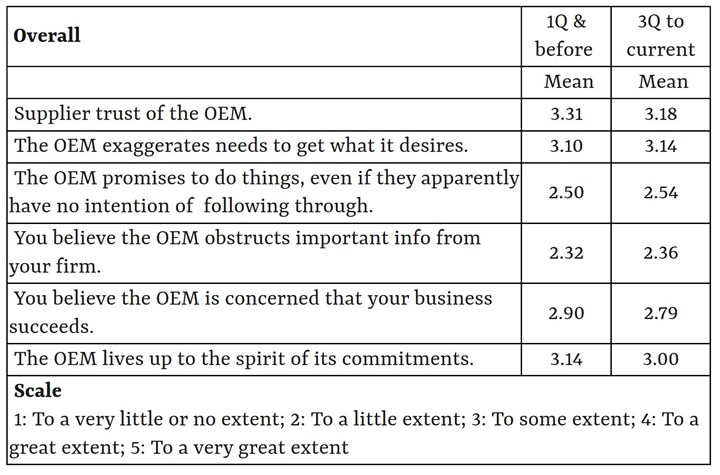

For example, when asked “Do you believe the OEM is concerned that your business succeeds?” overall supplier ratings fell from 2.9 (on a 5-point scale) prior to the industry shutdown in March and April to 2.79 by the end of the year.

Supplier relationships have weakened across key categories during the coronavirus pandemic. (Source: Plante Moran)

There was a similar drop-off on the question of “Does the OEM live up to the spirit of its commitments?” with scores falling from 3.14 to an even 3.0.

“Suppliers indicated that the trust in the customer declined as need exaggeration increased, commitments dropped off and information obstruction increased,” explains Dave Andrea, principal, Plante Moran.

The Good

Respondents identified several ways in which carmakers can improve supplier relations and the overall effectiveness of the value chain.

Plante Moran grouped the suggestions into six general best practices, half of which are communications related:

- Improved communication frequency and quality on a cross-functional basis, including sharing best practices on how other suppliers are handling manpower and HR-related issues.

- New methods and technology, with electronic communication for routine meetings and reviews are favored over in-person travel.

- Include upper management and encourage open forum sharing of concerns with particular attention to order quantities and willingness to adjust to help with capacity constraints.

- Enhanced safety & HR-related actions—leverage supplier expertise and monitor quarantines to protect production launch dates.

- Risk mitigation with sufficient information to assess the full situation (finances, production, personnel health and security), manage expectations and reinforce protocols.

- Financial support and cost containment, including tactical operations data analysis and detailed logistics information to help mitigate shipping costs and overseas sourcing.

Some are simple and intuitive, Andrea notes, while others will require an “industry workaround mentality.”

Bottom Line

The results reinforce the complexity of industry relationships, Andrea says, and “how OEM purchasing, logistics, finance payment terms, chargebacks and assembly plant cooperation need complete alignment.”

The strained relationships coming out of 2020, he adds, points to the need to “rebuild the reservoir of goodwill to call on when there is no playbook.”

Survivor Mode

At the same time, Andrea says, the industry has demonstrated a survival mentality during the pandemic that provides hope for the future.

“Once again, in crisis, the automotive value chain proves its resilience to rebound and deliver.