What Suppliers Look for from OEMs

What do suppliers think about their customers? Well, that answer—with a couple of exceptions—isn’t exactly a resounding hurrah.

The modern gift idea for a 20th-anniversary present is platinum, which is relevant in the context of the auto industry given the proliferation of models that are “Platinum” editions across OEMs. (The traditional gift idea is also germane, but a road we won’t go down at this time: China.)

The 20th annual North American Automotive OEM-Supplier Working Relations Index (WRI), has been released by Plante Moran, and odds are that with two exceptions—one in particular—there is not a whole lot of cause for celebration among the OEMs.

To greatly simplify what is a massive undertaking, the WRI measures how Tier 1 suppliers think about their OEM customers. What the relationship is like.

Simply: Toyota is far and away the best OEM (of the six measured) to work with.

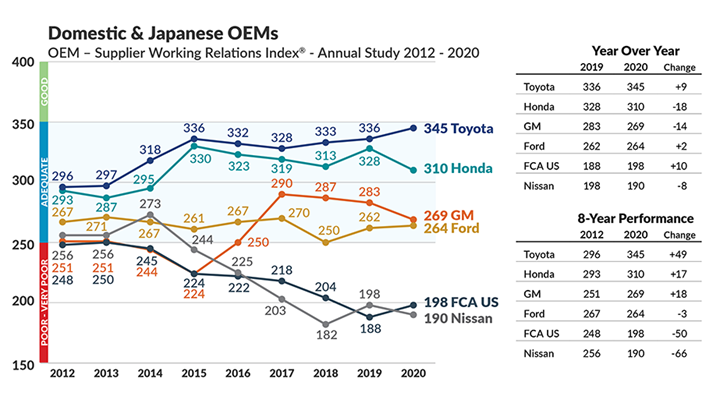

Toyota has a score of 345 points, which is up nine from 2019, when it also was #1.

In fact, of the last 20 years, there have been just two times when it wasn’t in first place. It was eclipsed by Honda both times, in 2009 and 2010.

And speaking of Honda, it is otherwise the perennial bridesmaid. This year its score was 310 points, which is actually a non-trivial tumble from the 328 it scored last year.

Still, Honda is well ahead of GM at 269 (down 14), Ford at 264 (up 2), FCA at 198 (up 10), and Nissan at 190 (down 8).

How They Get the Numbers

Dave Andrea, principal, Plante Moran Strategy and Automotive & Mobility Consulting Practice, explains that the survey, which was conducted from mid-February to mid-April (catching a bit of the COVID-19 conditions, especially for those suppliers who work with some of these OEMs in Asian and European markets), obtained responses from 841 salespersons from 503 Tier-1 suppliers, representing about 60% of the six OEMs’ annual buy. What’s more, the data is predicated on 2,752 buying situations that are divided into eight major purchasing areas and 20 commodity areas so, Andrea explains, the data is normalized, there is no possibility of “sour grapes” to affect the results.

Dave Andrea says it is important to look at the trends when discerning how well a particular company is doing on the WRI. (Image: Plante Moran)

Andrea emphasizes that the relations between the OEMs and suppliers is absolutely critical for the simple reason that some 60 to 70% of what makes a vehicle is sourced from suppliers, which means not only does that represent a big spend, but also has a huge impact on the revenue that can be obtained from the end customer (i.e., if the seat is not particularly comfortable but met a target cost, then that probably isn’t going to work out so well for the OEM despite the fact that Purchasing met its mandate).

Although this may be taking the wedding metaphor a bit far, it seems as though what makes for a good WRI is what makes for a good marriage: Trust and Communication.

Those are actually two metrics that Andrea and his colleague measured, and there is a direct correlation with how well an OEM did in those two areas with the overall WRI score.

And this isn’t something that is just “nice” to have, because they’ve also found that suppliers are more likely to invest in new technology to supply those OEMs they consider trustworthy and communicative.

The WRI looks primarily at Purchasing areas, but Andrea says that one of the things that helps make an OEM a better customer is an organization that is sufficiently cross-functional so that there aren’t, in effect, crossed wires when it comes to dealing with the supply base.

This is captured in two areas measured, “Engineering Impact on Cost” and “Purchasing & Engineering Conflicting Objectives.” The former goes to the point of the classic late engineering changes, which can end up costing suppliers money in order to accommodate for the necessary modifications.

Crossed Wires

The second is a bit more tricky. In this case, an OEM’s Purchasing department and Engineering department may send the supplier mixed messages. This makes it all the more difficult for the supplier to make a determination of what direction to take.

So for that category, a lower number is better, and the company that has the lowest number is—not surprisingly—Toyota, which comes in a 2.74 in 2020.

However, this category is somewhat exemplary of something that Andrea admits is a bit mystifying to him, which is that while Honda is maintaining its position in second place, it is weakening its hold. That is, in 2018 its score for “Purchasing & Engineering Conflicting Objectives” was 2.95. In 2019 that number was down to 2.81. Yet in 2020 it rose to 3.03, a number which is considered a statically significant change.

The Long View

One of the things that Andrea says is necessary is to consider not just this year’s number, but the overall trend that is shown in the WRI numbers. In this case, Toyota’s performance from 2012 to 2020 is remarkably solid: from 296 to 345, or an increase of 49. And GM is actually more improved than Honda: GM is up 18, from 251 to 269, while Honda is up 17, from 293 to 310 (so one really needs to see where both are starting from and presumably improving in the +300 zone compared to the mid-200 zone is probably a bit like dieting—it gets tougher as you try to lose those last few pounds). As for Ford, it is -3, which is probably only satisfying to the folks in Dearborn knowing that FCA is down 50 and Nissan is down 66.

Andrea anticipates that the results next year are going to be driven largely by the COVID-19 changes in the industry. “There is mutual dependency between the OEMs and the suppliers,” Andrea observes.

How much mutual support that exists right now is going to make a huge difference.

While it has always been important for good relations to exist between OEMs and suppliers, Andrea says this is going to become all the more important as there are going to be significant shifts in the bills of materials that go into their vehicles in the not-too-distant future (e.g., more software and electrification, fewer knobs and manifolds). A lot of the work to be done on transforming the vehicle systems is probably going to be done by suppliers—existing and new—so a bad reputation is not going to work out well for an OEM.

Let’s face it: there won’t be a whole lot of anniversary gifts given, platinum or otherwise.

.jpg;width=70;height=70;mode=crop)