Machine Tool Unit Orders Unchanged from a Year Ago, Dollars Up Slightly

Unit and dollar orders are moving in opposite for three reasons.

In April, machine tool sales were 2,136 units and $372,536,000. This was the second month in a row that orders were above 2,000 units. And, orders have been above 2,000 units in 11 of the last 13 months. Monthly orders of more than 2,000 units typically indicates a reasonably strong machine tool market. Compared with one year ago, unit orders were flat in April. The annual rate of change has been between 2.4 and 3.3 percent since November. So, the rate of growth has been low but consistent for six months. My unit forecast was too high by 18.2 percent in April. Year to date, my forecast was too high by 16.1 percent. Therefore, I have lowered my unit forecast for the remainer of the year. I see the annual rate of change continuing to grow through August but falling -1 to -2 percent the last four months of the year. This is primarily because the last four months of 2014 were very strong due to IMTS and the passage of bonus tax depreciation at the end of the year. In absolute terms, my forecast calls for higher unit order total in the second half of the year. It's just that in comparison to 2014 they will be down slightly.

Real dollar sales were about 10 percent higher than the typical monthly average. However, dollar sales were up just 0.9 percent from one year ago. This was the first time in three months that the one-month rate of change increased. But, the annual rate of change contracted for the second month in a row.

Unit and dollar orders are moving in opposite directions. I think there are three potential reasons for this:

1. Weak demand relative to supply. Demand for machine tools has likely weakened faster than the supply of machine tools. There are too many machines chasing too few buyers. Therefore, builders are lowering their prices to sell machines and keep inventories from rising. In this case, unit sales would still be good but average prices would be coming down, which would lead to weak dollar sales overall.

2. A strong U.S. dollar. Since August 2014, just after our Capital Spending Survey was completed, the U.S. dollar has seen unprecedented gains against all other world currencies. The U.S. dollar went from an annual growth rate of near zero in August 2014 to an annual growth rate of 12.0 percent at the end of April. The last time the dollar increased in value this fast was in 2009 during the financial crisis when the U.S. was viewed as safe haven for investors. Prior to that brief episode in 2009, the U.S. dollar has not grown this fast since 1998. The strong U.S. dollar allows foreign machine tool builders that import a significant number of machines to lower their prices yet still maintain their profitability in their home countries.

3. A change in the mix of machines being purchased. A change in the mix of machines being sold can happen for two reasons. One, buyers can switch to less expensive models of the machines they were planning to buy or they can switch to a less capable machine but one that can still get the job done. Two, the industries that are buying change. As an example, the oil and gas industry is not buying at as strong a rate as it was one year ago but another industry like medical improves. Since, oil and gas tends to buy large expensive machines in relatively small numbers while medical might buy more machines at a lower price, overall unit sales could still be okay while pulling down the total value of machines sold.

All three of these reasons are a factor in unit orders performing better than dollar orders, but it's hard to weight them.

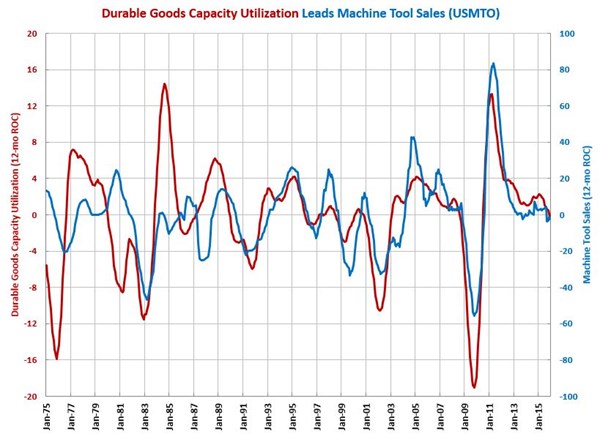

You can find more on machine tool sales and the leading indicators on our metalworking and monetary pages.

.JPG;width=70;height=70;mode=crop)