Durable Goods Orders Contract Sixth Month in a Row

This is the longest stretch of contraction since 2009.

Real durable goods new orders in July 2015 were $226,444 million. Compared with one year ago, durable goods new orders were down 21.3 percent. A significant reason for the decline was the dramatic drop in aerospace new orders. Compared with last July, aerospace orders were down 75.0 percent this month. Of course, last July's aerospace orders were abnormal for two reasons: 1) the large spike in aerospace orders usually happens in June and 2) July's orders were more than five times the average level of orders since January 1986. But, even if we combine aersopace orders for June and July, 2015's total was still 55.4 percent below that of 2014.

July was the sixth month in a row that the month-over-month rate of change contracted. The annual rate of change, which had grown at a slower rate the previous eight months, contracted in July for the first time since July 2013. Even if August's orders come in unchanged from last year, the rate of contraction in durable goods orders will accelerate next month.

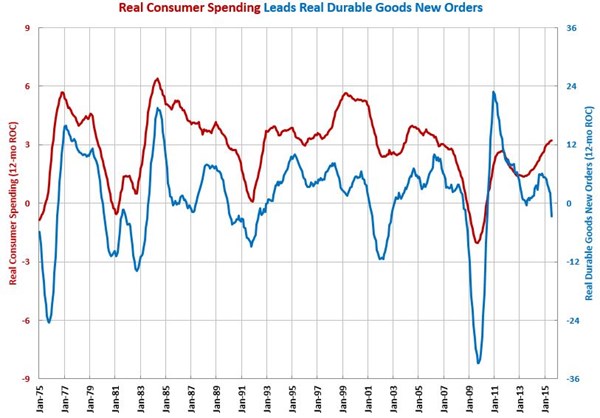

A good leading indicator for real capital goods new orders is real consumer spending. Month-over-month, consumer spending has been growing at a steady rate, near its historical average since August 2014. Annually, the rate of growth has been accelerating. This should indicate accelerating growth in durable goods new orders. But, these two series have diverged, which makes me wonder if all of the new seasonal adjustments applied to GDP and consumer spending are affecting the historic relationship between consumer spending and durable goods new orders.

We use real capital goods new orders to forecast activity in metalcutting job shops, metalworking, and durable goods.

.JPG;width=70;height=70;mode=crop)