Capital Goods Orders Contract for Fifth Straight Month

Total capital goods orders contracted 2.8% in March despite solid growth in motor vehicle and parts and aerospace new orders.

Real capital goods new orders in March 2015 were $101,179 million. While this was the second highest order since July 2014, orders in March 2015 were 2.8% lower than they were one year ago. This was the fifth month in a row that the month-over-month rate of change contracted. However, the rate of contraction has decelerated throughout that time period. This is a very volatile data series. But, the annual rate of change clearly has decelerated since July 2014. Therefore, capital goods orders are pointing toward slower capital spending at the moment. Total capital goods new orders tend to lead industrial production by three months and capital spending by 18 months on average based on long-term historical correlations.

Month-over-month, motor vehicle and parts new orders have increased the last four months and six of the last seven months. In March, MV&P new orders were up 12.2% compared with one year ago. That was the second fastest rate of growth since July 2014. The annual rate of growth has accelerated since November 2014. Aerospace orders got off to an abysmal start in the first two months of 2015, but they rebounded in March. Both non-defense and defense orders were up compared with last March. In total, aerospace orders were up 2.8% compared with one year ago. However, the annual rate of change continued to declerate, as it has since July 2014. Since July, the annual rate of growth has fallen to 6.9% from 30.5%. With both motor vehicle and parts and aerospace orders up in March and total orders down, we know that all other industries really struggled in the month of March.

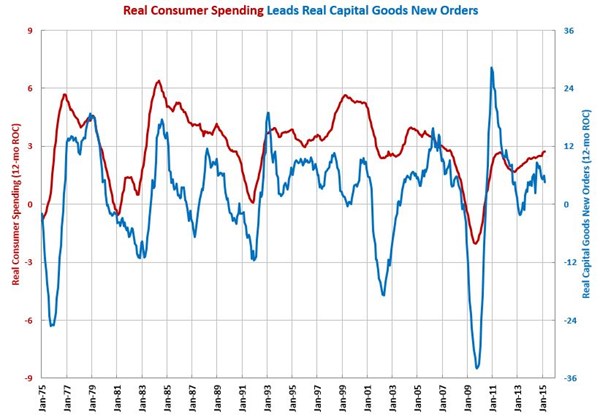

A good leading indicator for real capital goods new orders is real consumer spending. In the last couple of months, the month-ove-month rate of change in real consumer durable goods spending has been growing but the rate of growth was decelerating. The annual rate of change in total consumer spending and durable goods spending has started to decelerate. This indicates that real capital goods new orders likely will see further decelerating growth in 2015.

We use real capital goods new orders to forecast activity in metalcutting job shops, metalworking, and durable goods.

.JPG;width=70;height=70;mode=crop)