Real Fed Funds Rate Unchanged in June

This is the third month in a row that the real rate has slowly fallen. And,the year-over-year change in the Fed funds rate ticked up for the first time since April 2013.

#economics

The real Fed Funds rate was -1.46% in June 2014. This is the lowest the real rate has been since September 2013, but they rate was only marginally lower than last month. This is the third month in a row that the real rate has slowly fallen. However, the real rate has fluctuated in a very narrow band since September 2013 and has not changed significantly since April 2013.

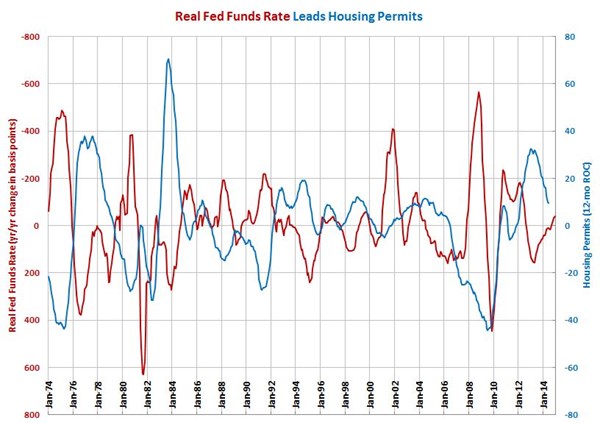

The year-over-year change in the Fed funds rate ticked up for the first time since April 2013. In June 2014, the real rate was just 11 basis points higher than it was one year ago. The rate of change was just 1 basis point higher than it was last month. The rate of change has been virtually flat the last three months.

If the nominal Fed funds rate says where it is currently and the rate of inflation remains at roughly 2% (it's been slightly higher than that the last two months), then the change in the real Fed funds rate will remain flat through August then accelerate lower through the first quarter of 2015. This would provide a boost to consumer durable goods spending and housing. Real interest rates tend to lead housing by about 12 months and consumer durable goods spending by about 15 months.

However, the Federal Reserve has hinted at rate hikes coming earlier than most people believe. This could just be talk, but if the Fed funds rate starts rising it will the positive effect of lower rates through next spring.

The real Fed funds rate is an important leading indicator for the following industries: appliances; automotive; custom processors; furniture manufacturing; hardware; HVAC; metalcutting job shops; off-road/construction machinery; petrochemical processors; plastics/rubber; pumps/valves/plumbing products; textiles/clothing/leather goods; and wood/paper.

RELATED CONTENT

-

On Urban Transport, the Jeep Grand Wagoneer, Lamborghini and more

Why electric pods may be the future of urban transport, the amazing Jeep Grand Wagoneer, Lamborghini is a green pioneer, LMC on capacity utilization, an aluminum study gives the nod to. . .aluminum, and why McLaren is working with TUMI.

-

On The German Auto Industry

A look at several things that are going on in the German auto industry—from new vehicles to stamping to building electric vehicles.

-

Report Forecasts Huge Economic Upside for Self-Driving EVs

Widespread adoption of autonomous electric vehicles could provide $800 billion in annual social and economic benefits in the U.S. by 2050, according to a new report.

.JPG;width=70;height=70;mode=crop)