The Cost of Doing Business

IMTS (International Manufacturing Technology Show) leaders take a closer a look at what it costs to gain — and retain — customers.

#customerfocus

The marketing ploys. The wiz-bang software. The paradigm shifting and out-of-box thinking and all. the. synergies. They all come down to one thing: the bottom line. The final—and really only—question any marketing effort will be judged by is how it contributed to the bottom line. Ultimately, what was the cost of doing business?

In this series, IMTS (International Manufacturing Technology Show) leaders have been walking readers through the customer journey—including their emotional experience. Now it’s time to take a closer a look at what it costs to gain—and retain—customers.

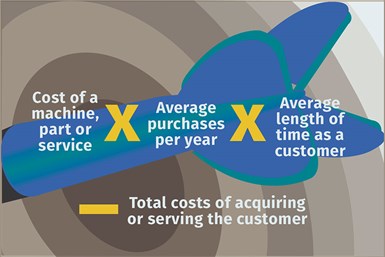

In the marketing world, the ultimate metric is customer lifetime value, or CLV. Customer lifetime value is the total amount that a customer is worth to your business. It is not based on a single purchase, but rather on predicted future purchases. Whether your customers are buying products or investing in services, CLV represents the total amount of money a customer is expected to spend with your business throughout their lifetime.

The formula looks like this:

CLV is a powerful data point because it can help you better respond to existing customers, as well as determine how much to invest in acquiring new customers. Using this data, you can easily focus—or refocus—your marketing efforts.

Retaining v. Gaining

Traditionally, marketing firms maintained that it cost far more to acquire a new customer than to maintain an existing customer. Hence, there was always a hyper focus on existing customers and keeping them at all costs. However, it is time to reevaluate that simplistic notion, according to Wharton Marketing Professor Peter Fader quoted in a Forbes article.

“Decisions about customer acquisition, retention and development shouldn’t be driven by cost considerations—they should be based on future value,” Fader said. He went on to explain that CLV is hard for many firms to conceptualize because it is based on predictions and not as clear cut as costs. However, he noted that using CLV is the right mindset because it accounts for the real value of customers.

Using CLV, marketers can avoid overvaluing so-so, long-time customers or undervaluing potentially excellent new customers. Old does not always equal good, and new does not always equal too expensive.

Using CLV you can:

- Determine what products or processes result in the highest CLVs. Focus on that product line.

- Create a profile of your most valuable clients. Target that industry, job function or type of customer.

- Monitor and improve customer experience. Listen to what customers are saying through their purchases and make improvements to your products and processes to match customer needs.

- Reward good customers. Think loyalty programs, discounts, freebies, and incentives. You have the data that proves which customers are most valuable to you. Make sure your relationship with them is reciprocal.

- Identify low-investment customers. There are no “bad” customers but pinpointing the customers who don’t spend very much or who have severed ties with your company can be helpful. Reach out to these dissatisfied customers and attempt to serve them before they become active detractors.

As you focus on quantifying and increasing CLV, encourage your team to use new tools that provide networking, sales and learning opportunities in one place. Enhance customer experiences with live demos. Give existing customers and prospects the chance to see your solutions in action.

Need more information?

Phone: 703-827-5215

Email: info@imts.com

RELATED CONTENT

-

Marketing: New World, New Rules — Think Fast

No matter what approach you use to evaluate your marketing, you have to be willing to act. If something is working, keep going. Things that sort of work may benefit from tweaking and further testing. If something fails out of the gate, abandon it — fast. It’s time for a new marketing scheme—one that is digital, agile and tested. We’ll focus on digital marketing and failing fast. Innovate, experiment, reevaluate, and repeat with these easy steps.

-

Increase in Technology Also Increases Communications

The speed of technology is causing ripple effects in the global manufacturing community from production all the way to market. Technology is advancing forward exponentially. As a Group Publisher, it is my duty to push the manufacturing audience with information and knowledge that will support them in their quest to be the best manufacturers they can be, using the latest delivery tools.

-

Search Visibility: Get Your Content Noticed Online with This One Tactic

Discover how to generate more leads by including researched, relevant keywords in your content to attract interested prospects who are looking for you online.