Despite Falling Oil Prices, Machine Tool Orders Strong in December

The South Central region suffered in December due to steep drop in the price of oil. But, this region and the oil and gas industry makes up a relatively small portion of total machine tool orders.

In the latest release of machine tool orders, almost all months saw an upward revision in the number of units sold. This was particularly true in October and November.

In December, machine tool sales were 2,616 units and $494,668,000. Outside of IMTS, December unit sales were easily the strongest of 2014. And, outside of the last two IMTS months, December unit sales were the second highest since September 2011. This was a strong month for unit sales indeed. For just the second time in the last five months (the other being September with IMTS), unit sales increased month-over-month. Although, I believe those other months were down because machine tool orders were either delayed or pulled forward for IMTS. By year end, machine tool unit orders increased 2.6%.

My unit forecast for December was too low by 14.0%. My original forecast, created in September 2013, ended the year too low by 3.6%. My revised forecast for the second half of the year, created in August 2014, was too high by 1.64%.

Real dollar sales increased 4.4% in December compared to one year ago. This was the third time in four months that real dollar sales have increased. This has led to four straight months of growth in the average price of a machine tool compared to one year ago. In fact, the average price in December was the highest since March 2014. Rising prices, especially with relatively stagnant unit sales, is an indication of increasing demand and bodes well for machine tool orders in 2015.

There has been some concern regarding machine tool orders in 2015 because of the steep decline in the price of oil. But, it's important to keep perspective. According to our capital spending survey, machine tool consumption at oil/gas-field/mining machinery manufacturers (basically, makers of drilling equipment) makes up just 1.9% of our projected total machine tool consumption. Even if we included all of the spending on pumps/valves/plumbing products (makers of infrastructure to move oil and natural gas as well as other fluids) as being hurt by the fall in the price of oil, which is a dubious assumption to make, these two end markets would amount to just 9.7% of total forecasted consumption. Plus, the fall in oil prices has been a boon to petrochemical processors and plastic/rubber product manufacturers. Our business index has shown improved activity in recent months at these facilities, which is at least partially a result of the drop in oil prices. Also, the automotive industry seems to be gaining steam with the fall in oil prices. This end market is vastly more important to the overall health of the metalworking industry than the oil and gas industry. And, if automotive remains strong, then that means the die/mold market should remain strong. That's projected to be the fourth largest end market for machine tools in 2015.

In fact, December's machine tool orders were very strong despite the dismal performance in the South Central region, which is all about oil and gas. With normal activity in that region machine tool orders would have been even stronger in December. The North Central - East, which has a heavy emphasis on automotive and die/mold, saw a 3.0% increase in unit orders compared to one year ago. And, even though the region sold about 80 fewer machines than it did during IMTS/September, real dollar sales were nearly $30,000,000 more than IMTS/September. So, in three of the last four months in the North Central - East real dollar sales have grown more 18% compared to one year ago. The Southeast, while smaller, also has a heavy emphasis on automotive. It has been growing faster than any other region.

As always, when forecasting it is important to keep everything in perspective and not react to the lastest headlines. While there may be more reason for some caution than there was four months ago, I have not changed my personal forecast for 2015. I'm still anticipating a 10-12% increase in unit orders and a 13-14% in dollar orders.

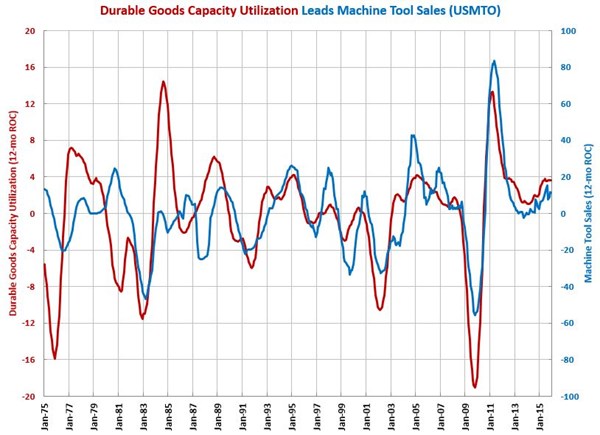

You can find more on machine tool sales and the leading indicators on our metalworking and monetary pages.

.JPG;width=70;height=70;mode=crop)