Capacity Utilization at Highest Level since January 2008

Durable goods capacity is at its highest level in some time and the rate of growth is accelerating. This indicates a significant increase in capital investment in 2015.

According to the Federal Reserve, durable goods capacity utilization was 78.6% in July 2014. This is the highest rate of capacity utilization since January 2008. This is the sixth month in a row of accelerating growth in the monthly rate of change. Capacity utilization was 4.8% higher in July 2014 than it was in July 2013. This is the fastest rate of month-over-month growth since April 2012. The annual rate of growth accelerated to 1.9%, which is the fourth month in a row that the annual rate of change has grown at an accelerating rate. This is the fastest rate of annual growth since May 2013.

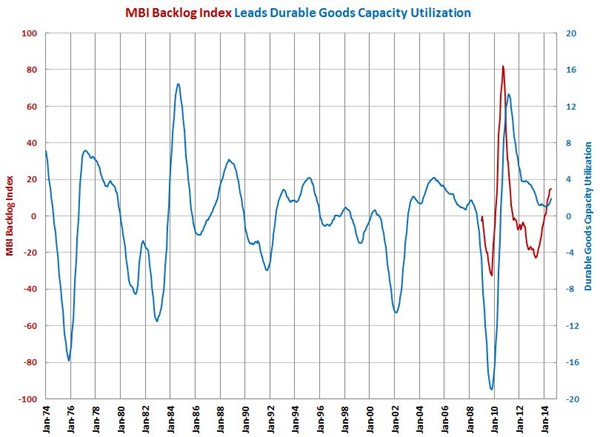

Most of my blog posts on capacity utilization this year have mentioned that the Gardner Business Index backlog index was pointing to a significant acceleration in capacity utilization. However, the government data wasn't reflecting that in the time frame I expected. But, the last two data releases from the Federal Reserve have revised capacity utilization significantly higher, bringing the rate of change of capacity utilization more in line with what was expected based on the Gardner Business Index. Our backlog index continues to indicate further accelerating growth in capacity utilization. The rate of growth should be quite dramatic, bringing capacity utilization near 80% for durable goods manufacturing. The last time durable goods manufacturing reached 80% capacity utilization was June 2000. The combination of a high level of capacity utilization and a rapid rate of growth in capacity utilization indicates that 2015 could be a very strong year for machine tool sales.

We use capacity utilization as a leading indicator for a number of industries, although it is not tracked for as many industries as industrial production. You can see the trends in capacity utilization for a number of industries below.

Accelerating Growth: aerospace; automotive; custom processors; durable goods; forming/fabricating (non-auto); furniture; machinery/equipment; petrochemical processors; plastics/rubber products; primary metals; printing; textiles/clothing/leather goods

Decelerating Growth: construction materials; wood/paper

Accelerating Contraction: electronics/computers/telecommunications

Decelerating Contraction: food/beverage processing

.JPG;width=70;height=70;mode=crop)