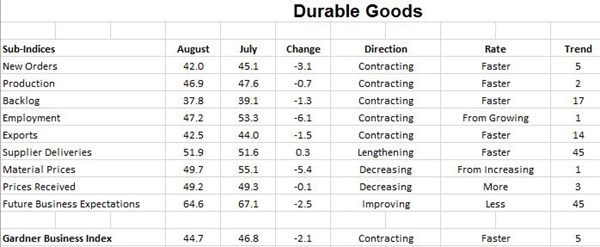

August GBI at 44.7 – Accelerating Contraction Continued

Durable goods manufacturing contracted at an accelerating rate for the fifth month in a row.

#economics

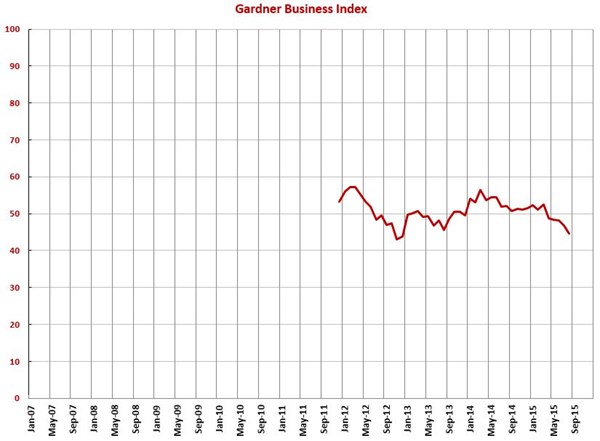

With a reading of 44.7, the Gardner Business Index showed that durable goods manufacturing contracted at an accelerating rate for the fifth month in a row. This is the first sustained period of contraction since the summer of 2013. Also, this was the lowest index since December 2012. In fact, this was the third lowest reading for the index since the survey began in December 2011.

New orders contracted for the fifth month in a row. The drop in the index the last two months was quite steep. The index was at its lowest level since December 2012. Production contracted for the second month in a row. The backlog index has trended lower since March 2014. It was below 40 for the second straight month and was at its lowest level since December 2012. The trend in backlogs indicated that capacity utilization in durable goods manufacturing will decline heading into 2016. The employment index fell to its lowest level since December 2011. This was the first significant contraction in employment since the survey began. The contraction in exports continued to accelerate due to the strong dollar and the slowing global economy. The export index was at its lowest level on record. Supplier deliveries continued to lengthen but the rate of lengthening has been relatively modest, which indicated increasing slack in the supply chain.

Material prices decreased for the first time since the survey began. Most commodities have seen a significant decrease in price due to the slowing global economy. Prices received decreased slightly for the third consecutive month. Since July 2014, the prices received index has trended gradually lower. Future business expectations have fallen steadily in 2015. In August, the index was at its lowest level since August 2013. Expectations have been below average the last four months.

All plant sizes contracted for the first time since December 2012. Plants with more than 250 employees contracted for the second time in three months. Facilities with 100-249 employees contracted for the third time in four months, but the rate of contraction has been minimal the last two months. Companies with 50-99 employees contracted for the second time in three months. Plants with 20-49 employees contracted for the fifth month in a row as their index fell to its lowest level since December 2012. Companies with 1-19 employees continued to contract. Their index fell to its lowest level since August 2013.

Every region contracted for the first time since August 2013. The Southeast was the best performing region for the third straight month. It was followed by the West, North Central-West, Northeast, North Central-East, and South Central. The South Central’s index was below 40.0 for the second time in five months.

The fastest growing industry in August was military. However, this industry gets limited response. The fastest growing industry with significant response was petrochemical processors. Also growing were automotive, aerospace, and off-road/construction machinery. All other industries contracted. From slowest to fastest contraction, the remaining industries were custom processors, other manufacturing, medical, forming/fabricating (non-auto), electronics/computers/telecommunications, pumps/valves/plumbing products, plastics/rubber products, metalcutting job shops, furniture, hardware, machinery/equipment, HVAC, power generation, primary metals, industrial motors/hydraulics/mechanical components, oil/gas-field/mining machinery, and ship building.

In addition to the overall durable goods index, we compute indices for a number of technologies or processes. All technologies contracted for the second month in a row. From slowest to fastest contraction, the technologies were moldmaking, plastics, finishing, screw machining, metalworking, and composites.

Planned capital expenditures improved from last month. They were roughly 50 percent more than two months ago and at their highest level since February 2015. However, compared with one year ago, they were still contracting at a significant rate.

RELATED CONTENT

-

On Quantum Navigation, EVs, Auto Industry Sales and more

Sandia’s quantum navi, three things about EVs, transporting iron ore in an EV during the winter, going underwater in an EV (OK, it is a sub), state of the UK auto industry (sad), why the Big Three likes Big Vehicles, and the future of logistics.

-

GM: The Drive to Profitability, Part 1

General Motors released rather impressive numbers for 2015.

-

On Lincoln-Shinola, Euro EV Sales, Engineered Carbon, and more

On a Lincoln-Shinola concept, Euro EV sales, engineered carbon for fuel cells, a thermal sensor for ADAS, battery analytics, and measuring vehicle performance in use with big data

.JPG;width=70;height=70;mode=crop)