Real Fed Funds Rate Unchanged from Last Month

Unless the rate of inflation begins to increase, the change in the real Fed funds rate will begin to stagnate in the next couple of months.

#economics

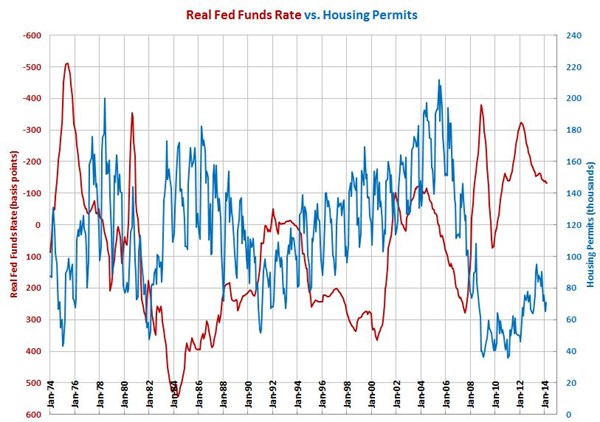

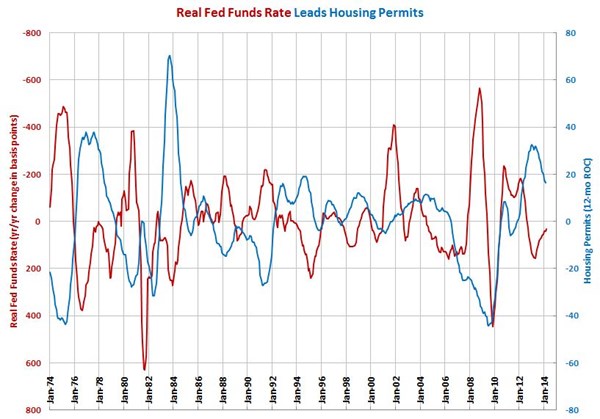

The real Fed Funds rate was -1.32% in March. The real rate was unchanged from February and remains the highest the real Fed funds rate has been since August 2010. Generally, the rate has been moving higher since February 2012. The year-over-year change in the Fed funds rate has been falling (moving up on the chart below) since April 2013. This trend in rates should provide a temporary boost to the housing market and the market for durable goods purchased with debt.

However, it is unlikely that the change in the Fed funds rate will push into negative territory (that is, the rate dropping from where it was one year ago). This is because the Fed funds rate is essentially zero and the rate of inflation is not increasing, which would help drive down the real Fed funds rate. In fact, the annual rate of inflation in March according to the CPI was 1.51%. Inflation has been 1.5% for three of the last four months. And, since November 2012, the annual rate of inflation has averaged 1.5%. In other words, based on the official rate of inflation, the Fed has been unable to increase price inflation despite all of its money printing. Unless the rate of inflation begins to increase, the change in the real Fed funds rate will begin to stagnate in the next couple of months. Therefore, the trend in interest rates will no longer be supportive of increased spending in the housing and durable goods markets.

The Fed funds rate is an important leading indicator for the following industries: appliances; automotive; custom processors; furniture manufacturing; hardware; HVAC; metalcutting job shops; off-road and construction machinery; petrochemical processors; plastics and rubber; pumps, valves, and plumbing products; textiles, clothing, and leather goods; and wood and paper.

RELATED CONTENT

-

Enterprise Edges into Self-Driving Car Market

U.S. rental car giant Enterprise Holdings Inc. is the latest company to venture into the world of self-driving vehicles.

-

On Quantum Navigation, EVs, Auto Industry Sales and more

Sandia’s quantum navi, three things about EVs, transporting iron ore in an EV during the winter, going underwater in an EV (OK, it is a sub), state of the UK auto industry (sad), why the Big Three likes Big Vehicles, and the future of logistics.

-

What Suppliers Need to Know Right Now

This is a time of reckoning for the auto industry, says Paul Eichenberg. He has some recommendations as to how companies can make their way through it.

.JPG;width=70;height=70;mode=crop)