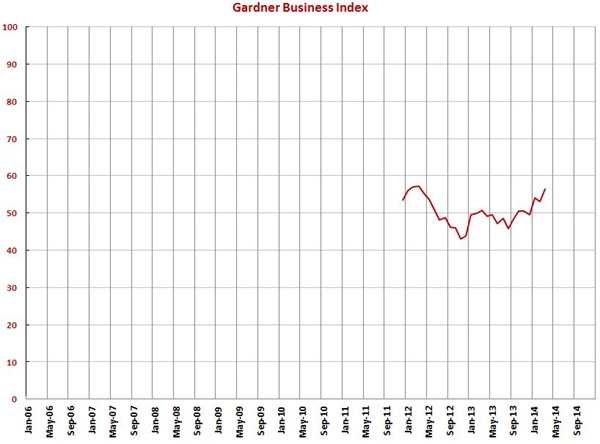

March GBI at 56.4 – Fastest Growth in Two Years

Compared to March 2013, the index was 11.0% higher. This is the seventh consecutive month that the index was higher than it was one year ago.

#economics

With a reading of 56.4, the Gardner Business Index shows that durable goods manufacturing grew for the third straight month and the fifth time in the last six months. The rate of growth this month was the fastest since March 2012. Compared to March 2013, the index was 11.0% higher. This is the seventh consecutive month that the index was higher than it was one year ago. The annual rate of change has grown at an accelerating rate for two consecutive months.

New orders have grown for six straight months. The rate of growth increased significantly to its fastest rate since March 2012. Production expanded for the third straight month, reaching its second fastest rate of expansion since the index began in December 2011. Backlogs grew for the second time in three months, which is the first growth in backlogs since early 2012. The trend in backlogs indicates that capacity utilization in durable goods manufacturing should increase throughout 2014. Employment has grown for seven months. The rate of increase in hiring has picked up substantially in 2014. Exports increased in March for just the second time in the history of the index. Supplier deliveries continued to lengthen at a faster rate as they have done since August 2013. Material prices continue to increase, but the rate of increase did slow down somewhat in March. Prices received increased for the fourth month in a row, but the rate of increase has been minimal the last two months. Future business expectations remain quite strong and were virtually unchanged from last month.

The index for all plant sizes improved in March. For plants with more than 20 employees, the rate of growth picked up significantly in March, reaching its fastest rate in roughly two years. Although the index did improve, plants with 19 employees or less contracted for the second straight month. The index for these plants was just 48.9, which is significantly less than the average index of roughly 59.0 for plants with more than 20 employees.

For the first time since April 2012, every region of the country expanded. The Pacific region grew at the fastest rate in March and has grown at faster rate for three straight months. It was followed by the East South Central, East North Central, South Atlantic, Middle Atlantic, West South Central, West North Central, New England, and Mountain regions.

In March every end market grew in which we received enough response to calculate an index. The plastics and rubber index hit a staggering 72.1, which is by far its fastest rate of growth since at least December 2012. It has grown five of the last six months as well. It was followed by electronics, automotive, forming and fabricating (non-auto), custom processors, machinery and equipment, medical, metalcutting job shops, aerospace, and industrial motors.

In addition to the overall durable goods index, we compute indices for a number of technologies or processes. The plastics industry grew at the fastest rate in March. It has grown four of the last five months. It was followed by the composites, metalworking, production machining, moldmaking and finishing industries. Every industry recorded an index of at least 55.0. For the third month in a row all of the industries expanded.

Planned capital expenditures increased 8.5% compared to one year ago. This was after they contracted by 22.0% last month. The annual rate of change in planned capital spending has grown at a slower rate for three months.

RELATED CONTENT

-

Enterprise Edges into Self-Driving Car Market

U.S. rental car giant Enterprise Holdings Inc. is the latest company to venture into the world of self-driving vehicles.

-

Mazda, CARB and PSA North America: Car Talk

The Center for Automotive Research (CAR) Management Briefing Seminars, an annual event, was held last week in Traverse City, Michigan.

-

on the Genesis GV60 interior, EV sales in H1, Bentley Bentayga's wood work, Faurecia's advanced manufacturing & more

The strange glowing orb in the Genesis GV60. . .global EV sales in the first half. . .creating wood for the Bentayga interior. . .the importance of material handling at Faurecia. . .lux ATPs. . .fast Porsche. . .fast Lambo. . .the Avalon Hybrid. . .Silverado steel. . .

.JPG;width=70;height=70;mode=crop)