Machine Tool Orders off to Weak Start in 2015

Machine tool orders were below 2,000 units for the second month in a row, which was the first time that has happened since January and February of 2014.

In February, machine tool sales were 1,800 units and $298,744,000. The last two months have seen orders significantly below the very strong total for December. This could be a result of pulling demand forward due to a hoped for continuance of bonus depreciation laws, which ultimately did pass with two weeks left in the year. A similar effect can be seen in the late 2013 and early 2014 data.

Unit orders in February were down 6.4% from one year ago. The month-over-month rate of change has contracted in four of the last five months. The annual rate of change has hovered around 3% for three straight months. My unit forecast was once again significantly off - too high by 25.0%. It is still too soon to revise my forecast for 2015, but if I'm that far off for another month or two then it will be time to take a fresh look at my forecast.

Real dollar sales in February were down 14.8% from one year ago. They have contracted in three of the last four months. Dollar sales performed worse than unit sales this month despite performing better than unit sales the previous two months. The annual rate of change was still positive at 1.0%, but this was the slowest rate of growth since dollar sales started growing in September 2014. My dollar forecast was too high by 27.2%

In February the average price of a machine was a paltry $166,000. This was the lowest average price since November 2012. Remember, last month had the highest average price for a machine since March 2013. Compared with one year ago, this was just the second time since August 2014 that the average price of a machine declined.

The West region recorded orders below 300 units for the second month in a row. That has not happened since January and February 2011. Real dollar sales continued to perform significantly worse than unit sales in the regio. Real dollar sales have contracted more than 30% for two straight months.

The South Central region continued to be in free fall. Comapred with one year ago, unit orders have contracted at an accelerating rate for four months. The rate of contraction was 57.4% in February. Real dollar orders were down a similar amount.

The North Central - West had the best performance in February. Unit sales increased 9.8% compared with February 2014. That was the second consecutive month of increasing unit orders. The annual rate of change has grown faster for two months. Dollar sales have been even stronger. They increased by 34.9% in February. Annually, real dollar sales were growing for the first time since July 2012.

Unit sales in the North Central - East contracted 8.6%. That was the third time in four months they have contracted. After growing the previous two months, real dollar sales contracted by 13.7% in February. However, the annual rate of growth in real dollar sales has accelerated the last two months.

In the Southeast, unit sales were up a whopping 44.8%. Annually, they are growing at 9.2%, which was the fastest rate of growth since July 2013. However, real dollar sales were essentially flat for the month. The annual rate of growth has slowed the last two months. The average price in the region fell to just $102,000, which was the lowest level since October 2009.

In the Northeast, unit sales increased by 6.3% compared with one year ago. However, real dollar sales decreased by 6.9%. Annually, unit sales growth has been flat to slightly positive while real dollar sales have contracted for four months.

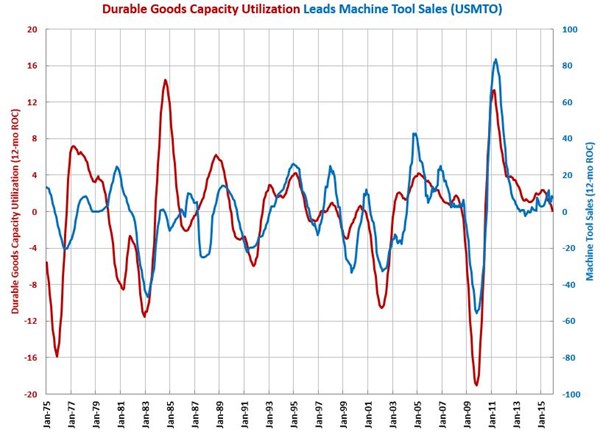

You can find more on machine tool sales and the leading indicators on our metalworking and monetary pages.

.JPG;width=70;height=70;mode=crop)