Machine Tool Orders Contract for Third Time in Four Months

A close look at the monthly data seems to indicate that a number of orders were held from June and July and pushed into September for IMTS. Also, it appears that orders were pulled forward from October and November into September for IMTS.

In the latest release from AMT, October orders were revised significantly higher. According to the USMTO, machine tool sales in November were 2,041 units and $369,829,000 in real dollars. Unit sales contracted 13.7% compared to last November. This is the second month in a row that unit sales contracted more than 10%. And, it is the third time in four months that unit sales have contracted. However, a close examination on the monthly order history seems to indicate that a number of orders were either delayed or pulled forward to IMTS.

I say this because if you smooth out the orders for the five months surrounding and including IMTS then the order total is right about where I would have expected it. So, my forecasts for individual months have been rather off but overall my forecasts remain quite close to actuals. For the month of November, my original forecast was too high by 5.3%. Year to date my original forecast from September 2013 is too low by just 2.0%. As I stated above, my revised forecast for the second half of 2014 is off quite a bit for individual months. But, for the five months of actual data I'm off just 1.8%.

Real dollar sales contracted 15.7% in November compared to last November. Real dollar sales have contracted six out of the last seven months. Also, the average price of machines contracted month over month for the first time since August.

The Southeast was the only region to see orders (both in units and dollars) increase compared to one year ago. Unit sales were about 11% and dollar sales about 25%. The biggest loser in November was the North Central, which saw unit sales contract about 30% and dollar sales about 26% from one year ago. Also, it's no surprise that the South Central saw a significant decline in orders from one year ago given the steep drop in oil prices the last several months.

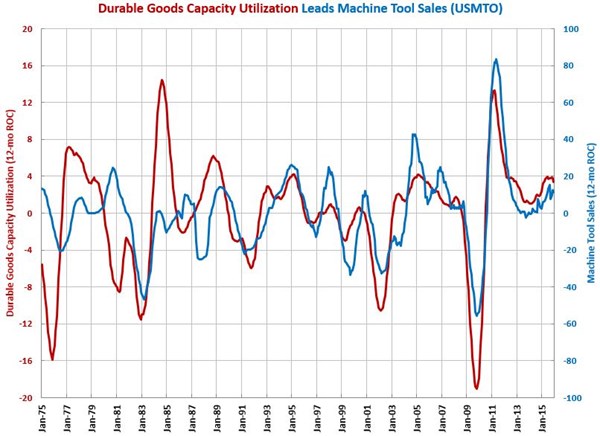

My four primary leading indicators for machine tool sales (money supply, durable goods capacity utilization, Gardner Business Index, and durable goods production) are pointing to a very strong year for the machine tool industry in 2015.

You can find more on machine tool sales and the leading indicators on our metalworking and monetary pages.

.JPG;width=70;height=70;mode=crop)