GBI for May: 47.0

In May, durable goods manufacturing contracted at a slightly slower rate and appeared to continue on the upward trend that began in December.

#economics

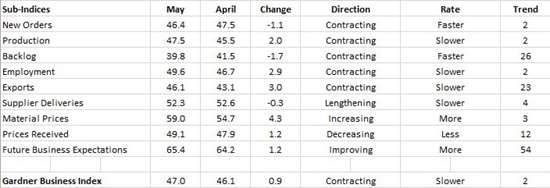

With a reading of 47.0, the Gardner Business Index showed that business conditions in durable goods manufacturing improved somewhat in May compared with April. In May, durable goods manufacturing contracted at a slightly slower rate and appeared to continue on the upward trend that began in December.

New orders contracted faster for the second month in a row. Production contracted at a slower rate than last and was still on an upward trend that started back in October. Backlogs remained in contraction as the rate of contraction accelerated the last two months. Employment was essentially flat in May. Exports contracted at virtually the slowest rate in the last 18 month. Supplier deliveries lengthened for the fourth month in a row.

The material prices index has increased dramatically since January. Material prices were increasing at their fastest rate since November 2014. Prices received continued to decrease, but the rate of decrease has slowly decelerated since November 2015. Future business expectations improved from last month and generally have improved since January.

Plants with more than 250 employees expanded for the third month in a row. Facilities with 100-249 employees contracted for the fifth consecutive month. Facilities with 50-99 employees expanded for the second time in three months. The two months of growth have been very strong. Companies with 20-49 employees contracted for the second month in a row. Companies with 1-19 employees continued to contract.

The Southeast was the best performing region for the seventh month in a row. The Southeast grew at its fastest rate since November 2014. All other regions contracted in May. From slowest to fastest contraction, they were the Northeast, North Central-East, West, North Central-West, and South Central.

HVAC was the fastest growing industry in May, growing at a substantial rate each of the last two months. It was followed by plastics/rubber products, petrochemical processors, hardware, electronics/computers/telecommunications, aerospace, custom processors, medical, and power generation. All other industries contracted. From slowest to fastest contraction they were industrial motors/hydraulics/mechanical components, machinery/equipment, other manufacturing, forming/fabricating (non-auto), automotive, primary metals, pumps/valves/plumbing products, metalcutting job shops, off-road/construction machinery, and oil/gas-field/mining machinery.

In addition to the overall durable goods index, we compute indices for a number of technologies or processes. In May, the only industry to grow was plastics. From slowest to fastest contraction, the others were composites, finishing, moldmaking, metalworking, and precision machining.

Planned capital expenditures for the next 12 months were at their second highest level since February 2015, nearly reaching their historical average. Compared with one year ago, planned spending increased 12.6 percent, which was the second month in a row of month-over-month growth. The annual rate of change has contracted at a slower rate each of the last three months.

RELATED CONTENT

-

On The German Auto Industry

A look at several things that are going on in the German auto industry—from new vehicles to stamping to building electric vehicles.

-

On Lincoln-Shinola, Euro EV Sales, Engineered Carbon, and more

On a Lincoln-Shinola concept, Euro EV sales, engineered carbon for fuel cells, a thermal sensor for ADAS, battery analytics, and measuring vehicle performance in use with big data

-

What Suppliers Need to Know Right Now

This is a time of reckoning for the auto industry, says Paul Eichenberg. He has some recommendations as to how companies can make their way through it.

.JPG;width=70;height=70;mode=crop)