Gardner’s Media Usage in Manufacturing 2014 – Part 1 Information B2B Marketers Can Definitely Use Today!

It’s said that knowledge is power … and that’s never been truer than in the “Information Age.” This is part 1 of a 6 part series of articles, discussing the findings of Gardner Business Media’s research study, Media Usage in Manufacturing 2014 and what they might mean to the B2B marketer.

By Mark Semmelmayer

Chief Idea Officer

Pen & Inc. Marketing Communications

This is part 1 of a 6 part series, discussing Gardner Business Media’s research study, Media Usage in Manufacturing 2014. In this series, I’ll endeavor to break down the findings of the study, and their implications for the B2B marketer, into bite sized chunks.

Understand from the outset, I’m a theorist and a student of the B2B game. I’m also a functional 40-year-plus B2B marketer. These posts will be written from the perspective of an active marketer who wants to apply study findings to improve marketing strategies and tactics today.

Part One - A Summary

To quote Gardner in their release of the survey, “Now in its fourth year … our annual media survey reveals the demographic characteristics and media usage trends of today’s manufacturing technology buyer. To assist in expanding the survey’s insights … we expanded the survey to include questions on vendor selection, lead nurturing and content preferences.”

Kudos to Gardner for this detailed study. It’s a continuation of a service B2B media companies have provided to B2B marketers for decades. I can’t count the times I updated my hard copy of Cahners Advertising Research Reports (CARR) in the 80s and 90s, or how many times I referred to it.

It’s in a media company’s best interests to provide marketplace data. First, it showcases their claim to having a meaningful seat at the table. Second, it instills customer confidence in their understanding of marketplace habits and needs. When a media company uses their resources to define market characteristics, marketers should take heed.

Picking Meat from the Bone: An Overview of Findings

1) Buying Cycle and Vendor Selection

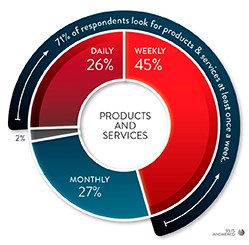

• More than 70% of buyers look for products or services at least once a week

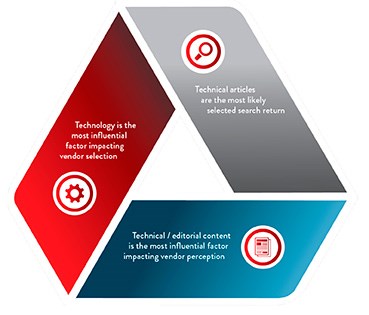

• The most influential criteria in selection is technology, followed by service and reputation

• Buyers use peers, technical articles and tradeshows to form a perception of vendors

2) Search

• Search engines are an essential research component

• Buyers using search are more likely to select search returns featuring known companies

• They prefer technical articles to other return types

3) Media

• Trade magazines remain the leading push media

• Websites and trade magazines are the most effective information resources used

4) Social Media

• Social media adoption has increased; however, perception of usefulness remains flat

• LinkedIn and YouTube continue to be the most useful social media sites for buyers

• Twitter and Facebook are blocked at nearly 20% of responding companies

5) Mobile Usage

• Overall mobile adoption is relatively flat

• Significant gains appear in laptop and tablet usage. Primary tablet use is email

• Manufacturers prefer browsers to apps when accessing web content on mobile devices

Getting a perspective … the old-fashioned way

B2B trade publishing has changed over the past decade. Once print-only journals have become multi-platform vehicles, a necessity for survival. While it’s not fair to say trade press has flourished, it has indeed survived. According to Statista (www.statista.com), total B2B trade publication revenue is nearing its record year of 2008. At that time, print page revenue was a little more than $4.5 billion, with digital advertising adding a paltry $201 million. In 2014, projections called for $3.2 billion in pages and $1.3 billion in digital revenue. In 2015, projected combined revenue will top 2008.

Trade media is, obviously, still relevant in B2B and a valuable, reliable source of marketing intelligence. But, you don’t have to wait for studies or white papers. Some of my best sources of information were my trade pub reps. That’s still true today. They can tell you (to a point) what competitors are doing, what others did that either flew or flopped and talk trends, tactics and philosophy.

So, what’s next?

Using the full report, I‘ll explore each of these five sets of findings in greater detail, (download the report here),detailing the implications for improving marketing effectiveness. Look for the next blog soon.

Need more information?

Mark Semmelmayer

Chief Idea Officer

Pen & Inc. Marketing Communications

Marietta, GA

770-354-4737

LinkedIn