Consumer Spending Grows at Slowest Rate since February

Despite the small upward revision in spending, the month-over-month rate of growth fell to 2.2%

According to the Bureau of Economic Analysis, real consumer spending in October 2014 was $11,009 billion real dollars (seasonally adjusted at an annual rate). While disposable income for 2014 was revised lower, consumer spending for the third quarter was revised slightly higher. The month-over-month rate of growth in consumer spending was 2.2%, which was the slowest rate of growth since February. This is still only two-thirds of the historic average month-over-month growth rate. The month-over-month rate of change has been between 2.0% and 2.7% every month but one since November 2012. The annual rate of change has been stuck at 2.4% since November 2013.

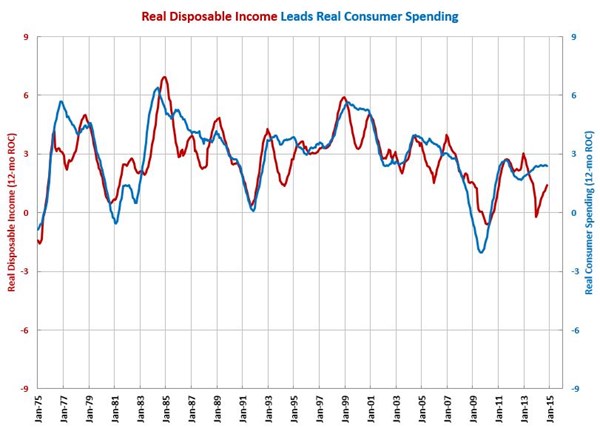

Real disposable income, a good leading indicator for real consumer spending, has been growing at an accelerating rate throughout 2014. However, the annual rate of growth of growth is still relatively weak in historic terms. The rate of growth in consumer spending is significantly higher than the rate of growth in disposable income. However, these two curves usually track each other quite closely. Therefore, even if the rate of growth in incomes continues to accelerate, there may not be much improvement in the growth rate of consumer spending.

While total consumer spending has been growing significantly slower than the historic average rate, real consumer durable goods spending continues to grow at an above average rate. The month-over-month rate of growth was 6.8%. The rate of growth has slowed the last two months. Durable goods spending as a percent of all consumer spending remains near record levels due to the ultra-low interest rates (particularly sub-prime automotive lending). In October, durable goods spending was 14.9% of all consumer spending, which is the second highest percent ever.

Real consumer spending (or its sub-components such as medical care spending) is an important leading for a number of durable goods end markets: construction materials; custom processors; durable goods; food/beverage processing; forming/fabricating (non-auto); hardware; HVAC; industrial motors/hydraulics/mechanical components; machinery/equipment manufacturing; medical; metalcutting job shops; oil/gas field/mining machinery; power generation; primary metals; and printing.

.JPG;width=70;height=70;mode=crop)