Capital Goods Orders Contract for First Time since June

Capital goods orders are very volatile, but the contraction in November was the fastest since February 2014.

According to the Census Bureau, real capital goods new orders in Novemberr 2014 were $85,821 million. Orders in November 2014 were 6.5% lower than they were in November 2013. November was the first month of month-over-month contraction since June 2014. And, it was the fastest rate of contraction since February 2014. However, this is a very volatile data series so we cannot make too much of one month. The annual rate of change slowed to 5.8% this month from its peak rate of growth of 8.6% in July. The annual rate of change still seems to be in an accelerating growth mode, but we could be very close to the peak rate of growth, if we haven't already seen it. Total capital goods new orders tend to lead industrial production by three months and capital spending by 18 months on average based on long-term historical correlations.

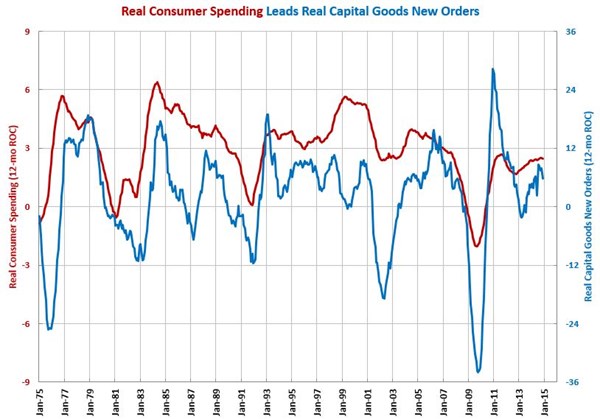

A good leading indicator for real capital goods new orders is real consumer spending. Since October 2013, the annual rate of change in real consumer spending has been virtually unchanged. Unless the rate of growth in real consumer spending accelerates it is likely that further accelerating growth in capital goods new orders will be limited.

We use real capital goods new orders to forecast activity in metalcutting job shops, metalworking, and durable goods.

.JPG;width=70;height=70;mode=crop)