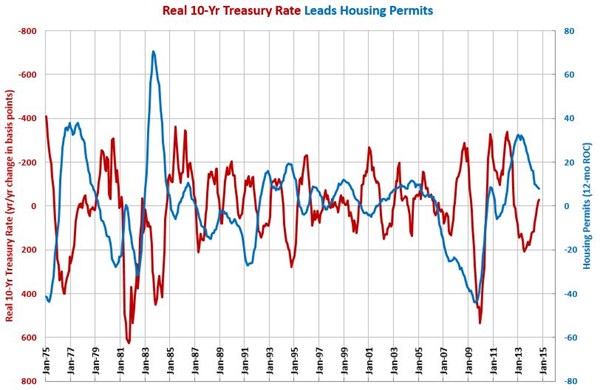

Real 10-Yr Treasury Rate Negative for Third Month

Year over year, the real rate has been trending lower since since July 2013. This is positive sign for housing and manufacturing.

The real 10-year treasury rate was 0.91% in September 2014. This was up slightly from last month, but the real rate has been less than 1.0% for three straight months. Since July 2013, the year-over-year change in the real 10-year treasury rate has been falling. It has been in negative territory, meaning the rate is lower than it was one year ago, for the three straight months.

The 10-year treasury rate is good leading indicator of the money supply, consutrction spending, and consumer durable goods spending. Currently, the trend in the change in the interest rate is moving in a direction that would indicate growth in the money supply, construction spending, and consumer durable goods spending. Interest rate changes tend to lead these data points by 12-15 months. Therefore, we should expect to see accelerating growth in these data points begin (or continue) between now and the end of the year.

The real Fed funds rate is an important leading indicator for the following industries: appliances; automotive; custom processors; furniture manufacturing; hardware; HVAC; metalcutting job shops; off-road/construction machinery; petrochemical processors; plastics/rubber; pumps/valves/plumbing products; textiles/clothing/leather goods; and wood/paper.

.JPG;width=70;height=70;mode=crop)