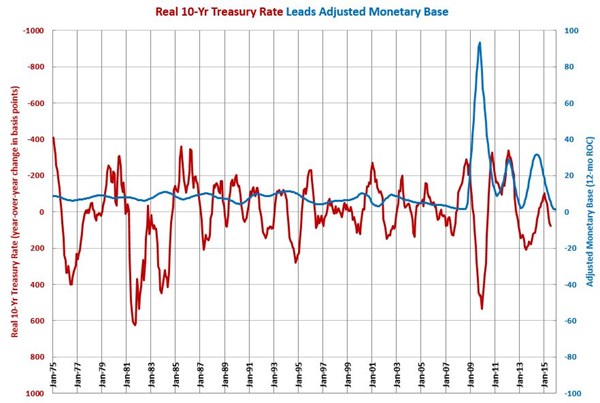

Real 10-Year Rate Climbs for 6th Month

Compared with one year ago, the change in the rate has increased for three straight months.

The real 10-year treasury rate was 1.74 percent in July 2015. This was the sixth month in a row that the real rate has risen compared with the previous month. This was the highest the real 10-year treasury rate has been since April 2011. Also, this was the third month in a row that the year-over-year change in the real rate was positive. And, it continues a trend of the change in the real rate increasing that began in February 2015. Even though it has risen for three months, the nominal rate is still only about a third of its historical average. However, inflation is historically low. The current annual average inflation is just 0.17 percent (that's the highest rate of annual inflation since December 2014) versus a historical average of 4.14 percent. Therefore, the real rate is about two-thirds of its historical average. Low inflation is keeping real rates relatively higher than in the past (remember, the real rate is the nominal rate minus inflation).

The Fed has indicated a desire for interest rates to rise, but has taken little action to make that happen. Although the Fed still claims it will raise rates this year. Increasing nervousness about the stock market, the U.S. economy, Greece, China and a host of other economic issues may keep the Fed from raising rates though. However, with very low (or negative) inflation and a generally stable yield, it is likely that the change in real 10-year treasury rates will continue to increase. This is a negative sign for manufacturing. However, interest rates have quite a long lead time before they begin to affect industrial production and capital equipment spending.

The 10-year treasury rate is good leading indicator of the money supply, consutrction spending, and consumer durable goods spending. The change in the real rate has turned to a negative indicator. Interest rate changes tend to lead these data points by 12-15 months. Therefore, we should expect to see decelerating growth in these data points begin (or continue) soon. Of course, this will largely depend on the Fed's decision to either raise interest rates or resume QE. Given the trend in rates, inflation, the exchange rate, and the overall economy, I find it hard to imagine that the Fed would raise rates. But, anything is possible.

The real Fed funds rate is an important leading indicator for the following industries: appliances; automotive; custom processors; furniture manufacturing; hardware; HVAC; metalcutting job shops; off-road/construction machinery; petrochemical processors; plastics/rubber; pumps/valves/plumbing products; textiles/clothing/leather goods; and wood/paper.

.JPG;width=70;height=70;mode=crop)