Rate of Growth in Monetary Base Slows to 32.0%

This is the fourth straight month that the month-over-month rate of change has declined.

In March 2014, the monetary base was $3.909 trillion dollars. That is 30.2% more than it was in March 2013. This is the fourth straight month that the month-over-month rate of change has declined. Last month in the dollar increase in the monetary base was much greater than the Federal Reserve's stated purchases. However, in March the dollar increase of the monetary base ($58 billion) was in line with Federal Reserve's stated amount of money printing. The annual rate of change, 29.9%, increased to its fastest rate of growth since July 2010. If the Fed actually continues with its taper, then the annual rate of growth should peak in June 2014. Since the monetary base leads capital equipment spending by about one year, this would indicate that the rate of growth in machine tool sales should peak sometime around the summer of 2015. You can see how the monetary base leads capital equipment spending at our monetary page.

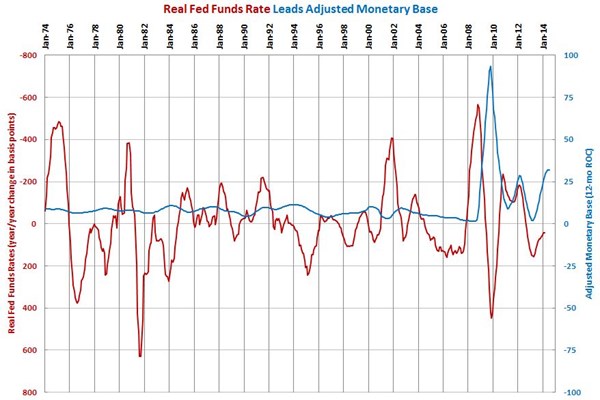

The real Fed funds rate is a good leading indicator for the adjsuted monetary base. Historically, change sin the real Fed funds rate have led changes in the monetary based by about one year. Although, that is a little hard to see on the chart below because the recent rate of change in the monetary base dwarfs what happened in the past. However, in recent years, the lead time between the real Fed funds rate and the money base has shortened. Unless inflation picks, the real rate will not go much lower and the year-over-year change will flatten out, indicating slower growth in the monetary base. And, that is the Fed appears ready to make happen.

.JPG;width=70;height=70;mode=crop)