Money Supply Contracts in June

June was just the second time the money supply contracted since October 2012.

In June 2015, the monetary base was $3.946 trillion dollars. This was a decrease of $10 billion from the previous month. Since July 2014, just before the end of QE, the monetary base has been bouncing above and below $4 trillion. Compared with one year ago, the monetary base decreased 0.5 percent. This was just the second month-over-month contraction in the monetary base since October 2012 (the other month of contraction being February 2015). If the monetary base stays at its current level, then it would contract every month but one from now until the end of the year. This would be the most extensive contraction in the month-over-month change in the money supply since 1949 as the U.S. exited the buildup in government spending from World War 2. One significant difference between then and today though is that the world is now awash in manufacturing capacity whereas in 1949 much of the world's manufacturing capacity had been destroyed in the war.

The annual rate of change continued to decelerate in June, as it has done since June 2014. This is a negative sign for future capital spending. Unless the Federal Reserve starts increasing the money supply, the annual rate of change will continue to decelerate.

You can see how the monetary base leads various machine tool sales and consumption data as well as primary plastics processing equipment at our monetary page.

The real 10-year treasury rate is a leading indicator for the adjusted monetary base. In 2015, the year-over-year change in the 10-year treasury has been decreasing at a slower rate. In the last month, the change has started increasing. This indicates a slower rate of growth in the monetary base. However, 10-year rates are being influenced by the Fed's own purchases and investors front-running the Fed's purchases. So, the 10-year may not be an accurate indicator of the money supply at the moment.

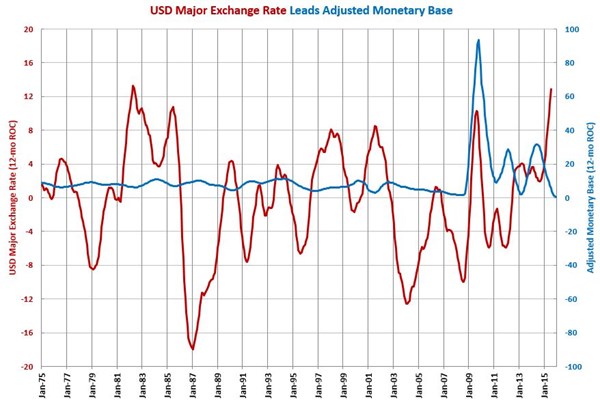

Also, the U.S. dollar major exchange rate (the USD compared to the other six major currencies of the world) and the U.S. dollar broad exchange rate (the USD compared to all world currencies) appear to be good leading indicators of the U.S. monetary base. The US dollar against the other major currencies of the world is growing at almost its fastest annual rate in more than 30 years. Normally, this indicates an expansion of the monetary base. But, the Fed seems to be moving the monetary base in the opposite direction.

.JPG;width=70;height=70;mode=crop)