Monetary Base Contracts Month-Over-Month in February 2015

This was the first month-over-month contraction in the monetary base since October 2012. Historically, this rarely happens.

In February 2015, the monetary base was $3.849 trillion dollars. This is the lowest level for the monetary base since January 2014. The February 2015 level was 0.1% lower than it was one year ago. The month-over-month rate of change has not contracted since October 2012. Historically, it is a very rare occurence. At the end of February, the annual rate of change was 15.5%, which was the slowest rate of growth since September 2013. If the Fed keeps the monetary base at its present level, then the annual rate of change would fall to -2.1% by the end of 2015. In fact, the annual rate of change would start contracting in October, which would be the first time that has happened since 1950. Of course, that was an entirely different time as the U.S. was reducing its WW2 deficit and was virtually the world's only country whose industrial production base was not damaged in the war.

Historically, changes in the monetary base lead changes in capital equipment spending by about two years. Therefore, the money supply is pointing to strong growth in machine tool consumption in 2015. Based on the trend in money supply, the peak rate of growth in capital equipment spending should occur in late 2015 or early 2016. Then, capital equipment spending likely will contract in 2016 and possibly in 2017. But, this is based on just one leading indicator. You can see how the monetary base leads various machine tool sales and consumption data as well as primary plastics processing equipment at our monetary page.

The real 10-year treasury rate is a good leading indicator for the adjusted monetary base. From early 2012 to the middle of 2013, the 10-year treasury was increasing at a rapid rate. I think this will correspond to a significantly slower rate of growth in the monetary base in the first half of 2015 or however long the Fed will be able to stand weak GDP growth, a rising dollar, and perhaps a falling stock market.

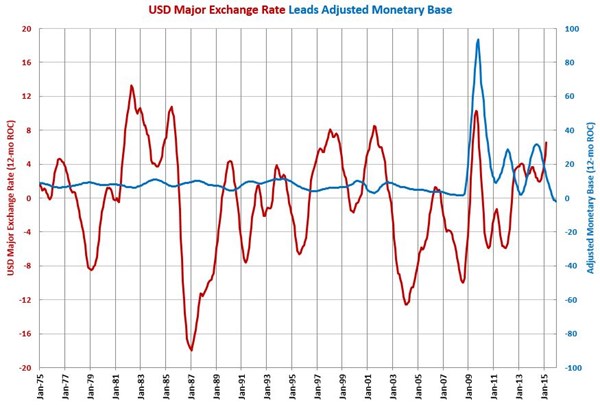

Also, the U.S. dollar major exchange rate (the USD compared to the other six major currencies of the world) and the U.S. dollar broad exchange rate (the USD compared to all world currencies) appear to be good leading indicators of the U.S. monetary base. The US dollar against the other major currencies of the world is growing at an accelerating rate. Normally, this indicates an expansion of the monetary base. But, the Fed seems to be moving in the opposite direction.

The current trend in the 10-year U.S. Treasury rate and exchange rates are clearly pointing toward accelerating growth in the monetary base. The question is will the Fed raise interest rates and slow the monetary base down before succumbing to the pressure to pump out more money once again?

.JPG;width=70;height=70;mode=crop)