Machine Tool Contraction Extends to Four Months

The Southeast region has bucked that trend though.

In August, machine tool sales were 1,680 units and $275,436,000. It is possible that these numbers are lower than what otherwise would have been expected because of the significant changes occuring in the sales/distribution channel in the U.S. Buyers could be delaying some purchases until the things settle down.

This was the fewest units sold in a single month since January (1,679) and the second fewest since February 2011. Compared with one year ago, unit orders contracted 19.1 percent, which was the fastest rate of month-over-month contraction since September 2013. This was the fourth month in a row that unit orders contracted. The annual rate of change was flat at 0.0 percent, which was the first time it has not grown since Feburary 2014. My revised forecast for the second half of the year was too high by 16.1 percent.

This was the lowest dollar sales since August 2010, which was also the last time that dollar sales were below $300,000,000. Real dollar sales contracted 23.1 percent in August. This was the seventh time in eight months that real dollar orders have contracted month-over-month. This was the fastest rate of month-over-month contraction since September 2013. The annual rate of contraction accelerated to 3.0 percent, which was the fastest rate of contraction since July 2014.

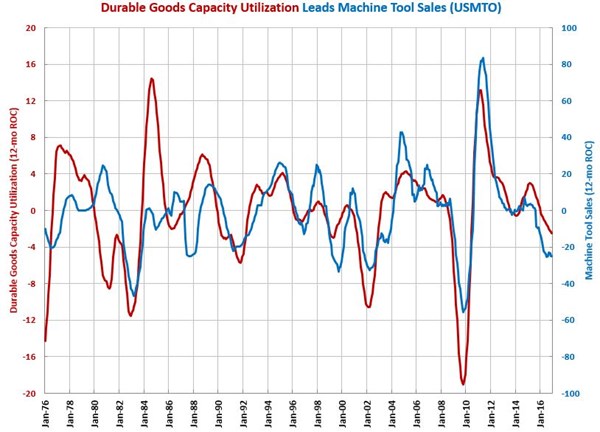

Almost all leading indicators are moving in a direction that point toward a typical contraction in the machine tool market. Historically, the average machine tool contraction (based on units) is about 25 percent. The average contraction typically lasts 18-24 months. Seeing as the contraction is already four months old, the peak rate of contraction should be just before IMTS. Historically, IMTS is usuallly a turning point in the industry, for the good or the bad. Therefore, in 2016, IMTS could be the time when the industry starts improving.

The Southeast region is bucking the trend of the overall industry. It is the only region that saw the number of units and dollars sold as well as the average price of a machine above the historical average for that region.

You can find more on machine tool sales and the leading indicators on our metalworking and monetary pages.

.JPG;width=70;height=70;mode=crop)