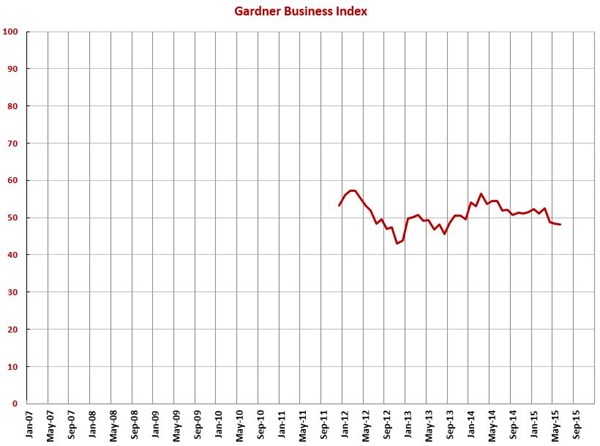

June GBI at 48.1 – Third Month of Accelerating Contraction

The rate of acceleration is mild but nonetheless present.

#economics

With a reading of 48.1, the Gardner Business Index showed that durable goods manufacturing contracted at an accelerating rate for the third month in a row. This is the first sustained period of contraction since the summer of 2013.

New orders contracted for the third month in a row, although the rate of contraction somewhat in June. Production increased for the 18th consecutive month. However, the rate of increase has been quite small the last three months. Over the last 18 months, production generally has been stronger than new orders. Therefore, backlogs contracted for the 15th straight month. Over that time, the trend in the backlog index has been fairly steadily down. This indicates a trend of lower capacity utilization and a reduced need for new capital equipment. Employment contracted for the first time since August 2013. Exports contracted at their fastest rate since December 2012. Supplier deliveries continued to lengthen, but they are lengthening at a slower rate than in 2014.

Material prices have increased at an accelerating rate for three months. However, the material prices index was still near its all-time lows in June. Prices received contracted at their fastest rate since the survey began in December 2011. Future business expectations declined for the third month in a row. The index is at its lowest level since August 2013

Material prices have increased the last two months. The rate of increase is still near the lowest in the survey’s history though. Prices received eked out a minimal gain after minimal decreases the previous two months. Future business expectations have fallen sharply the last two months to their lowest level since September 2013, which is about 5 percent the historic average.

Plants with more than 250 employees contracted for the first time since August 2013. Since that time the growth rate at these plants had been quite strong. After one month of contraction, plants with 100-249 employees expanded in June. These were the only plants to grow in June. Facilities with 50-99 employees contracted for the first time since September 2013. Companies with 20-49 employees contracted the third month in a row, although the rate of contraction has not been too fast. Companies with 1-19 employees continued to contract at a fairly significant rate.

The Southeast grew at the fastest rate in June. It was the only region to grow the last two months. The North Central-East also grew in June. It has expanded every month but one since September 2014. The Northeast contracted for the third month in a row, but the rate of contraction has slowed each month. The West contracted for the first time since January 2015. The North Central-West has seen its index fall significantly over the last four months. The South Central remained mired in a significant contraction.

Two industries had an index above 60 in June – furniture and HVAC. These industries have grown significantly the last four months. Ship building and power generation had an index above 55 in June after significant contraction the previous two months. Also growing were primary metals, forming/fabricating (non-auto), automotive, military, other manufacturing, electronics/computers/telecommunication, and industrial motors/hydraulics/mechanical components. While custom processors contracted, its index was above the total index for all industries. Plastics/rubber products, petrochemical processors, metalcutting job shops, medical, construction machinery, pumps/valves/plumbing products, and machinery/equipment all had an index in the 40s. Aerospace, hardware, and oil/gas-field/mining machinery had an index in the 30s.

In addition to the overall durable goods index, we compute indices for a number of technologies or processes. Composites and finishing eked at minimal gains in June. Plastics, moldmaking, metalworking, and screw machining contracted.

Planned capital expenditures have been below average for seven of the last nine months. Compared with one year ago, planned capital expenditures were down 55 percent in June.

RELATED CONTENT

-

On Global EV Sales, Lean and the Supply Chain & Dealing With Snow

The distribution of EVs and potential implications, why lean still matters even with supply chain issues, where there are the most industrial robots, a potential coming shortage that isn’t a microprocessor, mapping tech and obscured signs, and a look at the future

-

Auto vs. Tech: Guess Who Wins

Matthew Simoncini, president and CEO of Lear Corp., provided some fairly compelling figures this week at the CAR Management Briefing Seminars that show just how out-of-whack the valuations of tech companies are vis-à-vis auto companies.

-

Is The V8 Dead?

Tougher fuel economy standards may be the end of most V8s.

.JPG;width=70;height=70;mode=crop)