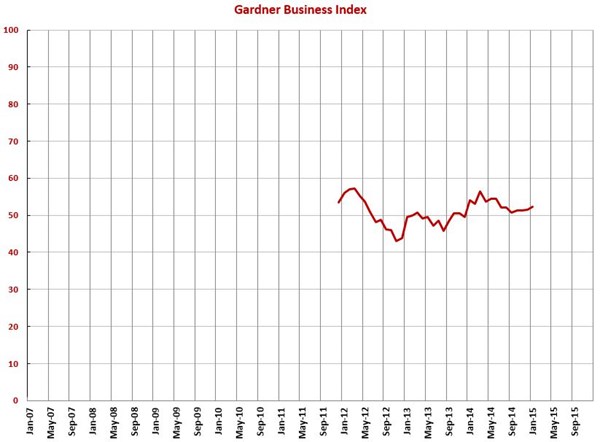

January GBI at 52.3 – Fastest Growth since June 2014

Despite the dramatic fall in oil prices, particularly since October, the durable goods manufacturing industry has been gaining momentum.

#economics

With a reading of 52.3, the Gardner Business Index showed that durable goods manufacturing grew for the 13th consecutive month and for the 15th time in the last 16 months. The index has increased every month since September 2014, and the index is at its highest level since June 2014. So, despite the dramatic fall in oil prices, particularly since October, the durable goods manufacturing industry has been gaining momentum. However, compared to one year ago, the index was down 3.1%. The annual rate of growth decelerated for the fourth month in a row but is still at a healthy 6.6%.

New orders grew for the 16th month in a row, and the index is at its highest level since June. The rate of growth has trended up significantly since November. Production expanded for the 13th month in a row. It was at its highest level since last March. Backlogs contracted for the 10th month in a row, but the backlog index has trended up since September. Compared to one year ago, the backlog index decreased 7.4% and for the second time in three months. The annual rate of change in backlogs has grown at a slower rate for five months, which indicates that the rate of growth in capacity utilization should peak around the end of the first quarter in 2015. Employment has increased for 17 straight months but the rate of growth has been more moderate compared to the first half of 2014. Exports contracted for the ninth consecutive month due to the relative strengthening of the dollar. Supplier deliveries continued to lengthen at a rate similar to that of the last 12 months. Material prices increased at a dramatically slower rate, likely due to the decline in oil prices. The material prices index was at its lowest level since August 2012. Prices received have increased for nine months in a row, which is the longest stretch of price increases since the summer of 2012. While they slipped somewhat from last month, future business expectations continued to rebound.

The index at larger facilities remained at the high level seen last month. The index at plants with 50-99 employees surged to its highest level since March 2014. Plants with 20-49 employees move to expansion from contraction. But, the smallest facilities contracted once again. Business conditions at small facilities have been difficult since early 2012.

With the steep fall in oil prices, the South Central continued to take it on the chin. Its index in January was easily the lowest since the survey began in December 2011. However, the North Central – East has boomed the last couple of months. It was growing at its fastest rate since March 2014. This is also true of North Central – West. And the Southeast grew for the fifth time in six months. Like the South Central, the Northeast and West contracted this month.

Industrial motors/hydraulics/mechanical components was easily the fastest growing industry in January. In fact, it was only the second time ever that any industry has had an index of more than 70. It was followed by petrochemical processors, automotive, plastics/rubber products, machinery/equipment, aerospace, primary metals, and custom processors. All grew at significant rates. Metalcutting job shops and forming/fabricating (non-auto) saw a slight contraction. Electronics/computers/telecommunication saw a significant drop in its index and is now contracting. Medical has contracted sharply the last two months.

In addition to the overall durable goods index, we compute indices for a number of technologies or processes. The plastics industry grew at the fastest rate for the third month in a row. It was followed by finishing, composites, moldmaking, and metalworking. Only screw machining contracted this month.

Planned capital expenditures improved slightly from last month, but contracted more than 20% month-over-month for the second month in a row. The annual rate of change has contracted at an accelerating rate each of the last three months.

RELATED CONTENT

-

On Quantum Navigation, EVs, Auto Industry Sales and more

Sandia’s quantum navi, three things about EVs, transporting iron ore in an EV during the winter, going underwater in an EV (OK, it is a sub), state of the UK auto industry (sad), why the Big Three likes Big Vehicles, and the future of logistics.

-

On Urban Transport, the Jeep Grand Wagoneer, Lamborghini and more

Why electric pods may be the future of urban transport, the amazing Jeep Grand Wagoneer, Lamborghini is a green pioneer, LMC on capacity utilization, an aluminum study gives the nod to. . .aluminum, and why McLaren is working with TUMI.

-

Auto vs. Tech: Guess Who Wins

Matthew Simoncini, president and CEO of Lear Corp., provided some fairly compelling figures this week at the CAR Management Briefing Seminars that show just how out-of-whack the valuations of tech companies are vis-à-vis auto companies.

.JPG;width=70;height=70;mode=crop)