GBI for March: 50.0

This was the first time since last March that durable goods manufacturing did not contract.

#economics

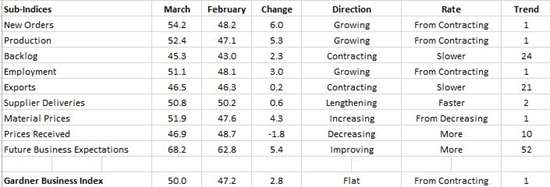

With a reading of 50.0, the Gardner Business Index showed that business conditions in durable goods manufacturing were unchanged in March compared with February. This was the first time since last March that the industry did not contract. The index has increased significantly in the first quarter of 2016, indicating that durable goods manufacturing is entering a recovery.

New orders grew for the first time in 12 months, and production increased for the first time since June 2015. With new orders improving more than production in recent months, the backlog has increased significantly since November even though it remains in contraction. Employment increased for the first time since July. Exports remained mired in contraction, but the rate of contraction has slowed in recent months. Supplier deliveries lengthened for the second month in a row, indicating increased activity throughout the supply chain.

Material prices increased for the first time since July, but the rate of increase remained low historically. Prices received decreased for the 10thconsecutive month. The rate of decrease in prices received has moderated somewhat in recent months. Future business expectations have improved noticeably the last two months, reaching their highest level since April 2015.

Plants with more than 250 employees expanded after three months of contraction. Facilities with 100-249 employees contracted for the third consecutive month. Facilities with 50-99 employees grew for the first time since July, and the rate of growth was quite strong. Companies with 20-49 employees grew at an accelerating rate for the second month in a row. Companies with 1-19 employees continued to contract but had their highest index since June 2015.

While every region contracted last month, four of the six regions grew in March. The Southeast was the best performing region for the fifth month in a row. The Southeast grew at its fastest rate since April 2014. It was followed by the North Central-West, Northeast, and West regions. The North Central-East contracted for ninth month in a row but at its slowest rate. The South Central continued to contract, but the rate of contraction has improved noticeably the last two months.

Furniture was the fastest growing industry in March with an index of 66.7. It was followed by plastics/rubber products, aerospace, custom processors, hardware, electronics/computers/telecommunications, and medical. Metalcutting job shops and petrochemical processors were flat. Industries from slowest to fastest contraction were off-road/construction machinery, machinery/equipment, industrial motors/hydraulics/mechanical components, forming/fabricating (non-auto), other manufacturing, HVAC, power generation, automotive, primary metals, pumps/valves/plumbing products, military, and oil/gas-field/mining machinery.

In addition to the overall durable goods index, we compute indices for a number of technologies or processes. Plastics grew at the fastest rate in March. Moldmaking also expanded this month. Composites was unchanged. From slowest to fastest contraction, the technologies were metalworking, precision machining, and finishing.

Planned capital expenditures for the next 12 months contracted almost 12 percent compared with one year ago. This was the slowest rate of contraction since February 2015. The rate of contraction has decelerated for six consecutive months, indicating a potential increase in capital spending later this year.

RELATED CONTENT

-

Auto vs. Tech: Guess Who Wins

Matthew Simoncini, president and CEO of Lear Corp., provided some fairly compelling figures this week at the CAR Management Briefing Seminars that show just how out-of-whack the valuations of tech companies are vis-à-vis auto companies.

-

On Global EV Sales, Lean and the Supply Chain & Dealing With Snow

The distribution of EVs and potential implications, why lean still matters even with supply chain issues, where there are the most industrial robots, a potential coming shortage that isn’t a microprocessor, mapping tech and obscured signs, and a look at the future

-

On The German Auto Industry

A look at several things that are going on in the German auto industry—from new vehicles to stamping to building electric vehicles.

.JPG;width=70;height=70;mode=crop)