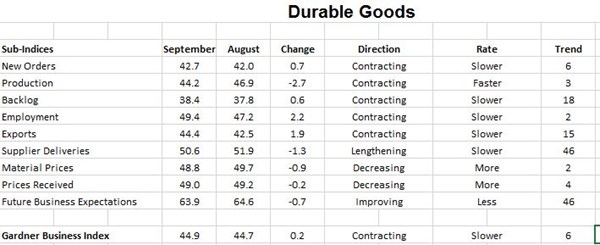

Gardner Business Index for September: 44.9

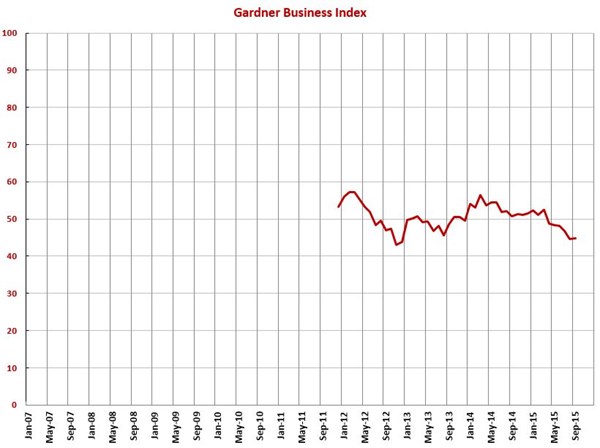

With a reading of 44.9, the Gardner Business Index showed that durable goods manufacturing contracted for the sixth month in a row.

#economics

With a reading of 44.9, the Gardner Business Index showed that durable goods manufacturing contracted for the sixth month in a row. This is the first sustained period of contraction since the summer of 2013.

New orders contracted at a slightly slower rate than last month but still nearly the fastest rate in two years. Production contracted at an accelerating rate for the third month in a row. The backlog index was still contracting in September, but the rate of contraction has stabilized. Employment contracted for the second month in a row. Exports remained mired in contraction due to the strengthening of the dollar. Supplier deliveries were still lengthening but the pace of lengthening has slowed dramatically since December 2014.

Material prices contracted for the second month in a row. These are the only two months of contraction since the index began in December 2011. Prices received have decreased moderately for four months. Future business expectations continue to slide and were at their lowest level since December 2012.

Only plants with more than 250 employees expanded in September. They have grown two of the last three months.

In September, every region contracted for the second month in a row. All regions contracted at a similar rate to last month.

The fastest growing industry in September was hardware. However, this industry gets limited response. The fastest growing industry with significant response was automotive. Also growing was electronics/computers/telecommunications. Two industries were flat: construction materials and HVAC. All other industries contracted. In order from slowest to fastest contraction they were: aerospace, forming/fabricating (non-auto), metalcutting job shops, custom processors, industrial motors/hydraulics/mechanical components, machinery/equipment, furniture, power generation, plastics/rubber products, petrochemical processors, primary metals, pumps/valves/plumbing products, medical, military, off-road/construction machinery, and oil/gas-field/mining machinery.

In addition to the overall durable goods index, we compute indices for a number of technologies or processes. All technologies contracted for the third month in a row. From slowest to fastest contraction, the technologies were plastics, finishing, moldmaking, composites, metalworking, and screw machining.

Planned capital expenditures fell to their third lowest level on record. Compared with one year ago, they contracted 29 percent.

RELATED CONTENT

-

Fuel Economy Gains in July

What you’re looking at here is a sales-weighted fuel economy chart (the numbers in the white boxes represent miles per gallon) that was put together by two diligent researchers, Michael Sivak and Brandon Schoettle, of the University of Michigan Transportation Research Institute.

-

Report Forecasts Huge Economic Upside for Self-Driving EVs

Widespread adoption of autonomous electric vehicles could provide $800 billion in annual social and economic benefits in the U.S. by 2050, according to a new report.

-

On Global EV Sales, Lean and the Supply Chain & Dealing With Snow

The distribution of EVs and potential implications, why lean still matters even with supply chain issues, where there are the most industrial robots, a potential coming shortage that isn’t a microprocessor, mapping tech and obscured signs, and a look at the future

.JPG;width=70;height=70;mode=crop)