Durable Goods Production Grows at Slowest Rate since January 2010

Slowing growth in durable goods production is pointing towards slower growth in capital spending later this year and into 2016.

The durable goods industrial production index was 112.4 in May 2015. In nine of the last 10 months the index has been above 110.0. May was the 29th consecutive month that the index set a record high for the given month. However, the one-month rate of change slowed to 2.3 percent, which was the slowest rate of growth since January 2010. January 2010 was the first month of month-over-month growth in the production index since the financial collapse happened. So, basically, the May 2015 durable goods industrial production index had the slowest rate of growth since the recovery in manufacturing began. The rate of growth in production through the first five months of 2015 is about half of what it was in the second half of 2014. The annual rate of growth decelerated to 4.7 percent, which was the third straight month that the growth rate decelerated.

Since starting to forecast industrial production in August 2014, I have never missed by more than 0.9%. I think growth in production will continue to decelerate in 2015. By year end, I think production will have increased 1.3% compared with 2014.

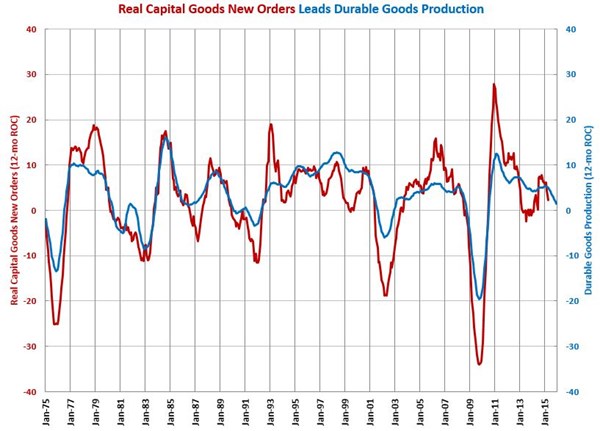

The best leading indicators for durable goods production are housing permits, capital goods new orders, and consumer durable goods spending. Housing permits seemed to have bottomed and are poised for accelerating growth. The one-month rate of change in capital goods new orders has contracted for six months and the annual rate of change is growing at a much slower rate. Durable goods spending is still growing at a relatively strong rate and above its historical average.

We track industrial production and its leading indicators for a number of industries. Click on the links below to see how each industry is faring.

Accelerating Growth: hardware; HVAC; industrial motors/hydraulics/mechanical components; petrochemical processors; power generation; printing; textiles/clothing/leather goods;

Decelerating Growth: aerospace; appliances; automotive; construction materials; custom processors; durable goods; electronics/computers/telecommunications; food/beverage; forming/fabricating (non-auto); furniture manufacturing; machinery/equipment; medical; metalcutting job shops; military; off-road/construction machinery; oil/gas-field/mining machinery; plastic/rubber products; primary metals; pumps/valves/plumbing products; ship building; wood/paper products

Accelerating Contraction: none

Decelerating Contraction: none