August GBI at 52.1 – Solid Growth Continues

Durable goods manufacturing has grown for eight consecutive months. The annual rate of growth has been accelerating significantly throughout 2014.

#economics

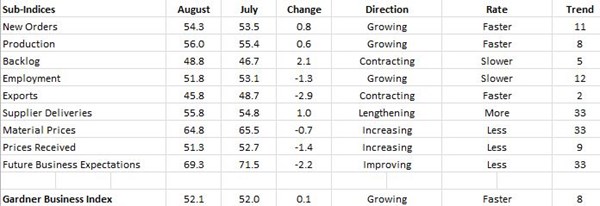

With a reading of 52.1, the Gardner Business Index showed that durable goods manufacturing grew for the eighth consecutive month and for the 10th time in the last 11 months. The industry grew at virtually the same rate in August as it did in July, which was the slowest rate of growth in 2014. However, the index was 13.8% higher this August than it was in August 2013. This was just the third time in 2014 that the month-over-month rate of growth was in double digits. The annual rate of growth has accelerated every month in 2014 and was above 10% for the first time in August.

New orders grew for the 11th month in a row. Production expanded for the eighth month in a row. Both new orders and production grew at a slightly faster rate than they did last month. Backlogs contracted for the fifth month in a row. The rate of contraction in August was noticeably slower. The backlog index was 26.4% higher than it was last August, which was the fastest rate of month-over-month growth in backlogs since November 2013. The annual rate of change in backlogs continued to grow at an accelerating rate, which indicates significant gains in capacity utilization. Employment has increased for 12 straight months, but the rate of growth in August was the slowest of 2014. Exports contracted for the fourth consecutive month, and the rate of contraction has accelerated each month as the dollar has been relatively strong recently. Supplier deliveries continued to lengthen at an increasing rate. They are increasing at their fastest rate since April 2012. Material prices continue to increase at a significant rate, but the rate of increase has slowed for two straight months. Prices received have increased for four months in a row, which is the longest stretch of price increases since the summer of 2012. Despite the many positives in these sub-indices, future business expectations have fallen sharply the last two months. In August, they were at their lowest level since September 2013.

Plants with more than 250 employees have seen a slower rate of growth the last two months. In fact, this was the only plant size category to see a significant change in business conditions the last two months. And, these large facilities were the only ones to report a significant change in future business expectations. Facilities with 19 employees or fewer continue to be the only plants that are contracting.

Five of the six regions expanded in July. For the third month in a row, the South Central grew at the fastest rate. Its index has seen faster growth each of the last four months. It grew at the fastest rate by far in August. It was followed by the Southeast, which contracted last month, the North Central – West, the Northeast, and the West. The only region to contract in August was the North Central – East. The contraction was very slight and the first month of contraction for this region since December 2013.

More industries contracted this month than last month. However, the industries that expanded did so at a very fast rate. All of the following industries had an index above 56.0: machinery/equipment, medical, forming/fabricating (non-auto), plastic/rubber products, electronics/computers/telecommunications, and primary metals. Custom processors also grew but at a slower rate. Aerospace, automotive, and metalcutting job shops moved from expansion to contraction. Industrial motors/hydraulics/mechanical components continued to contract as well.

In addition to the overall durable goods index, we compute indices for a number of technologies or processes. The screw machining industry grew at the fastest rate in August with an index of 53.4. It was followed by the plastics, metalworking, finishing, and moldmaking industries. The composites industry had an index of 49.9 and was the only industry to contract.

After contracting last month, planned capital expenditures increased 2.7% compared to last August. The annual rate of growth is still in double digits, but the rate of growth has decelerated the last two months. The annual rate of change was at its slowest rate of growth since November 2013.

RELATED CONTENT

-

On Lincoln-Shinola, Euro EV Sales, Engineered Carbon, and more

On a Lincoln-Shinola concept, Euro EV sales, engineered carbon for fuel cells, a thermal sensor for ADAS, battery analytics, and measuring vehicle performance in use with big data

-

Auto vs. Tech: Guess Who Wins

Matthew Simoncini, president and CEO of Lear Corp., provided some fairly compelling figures this week at the CAR Management Briefing Seminars that show just how out-of-whack the valuations of tech companies are vis-à-vis auto companies.

-

Enterprise Edges into Self-Driving Car Market

U.S. rental car giant Enterprise Holdings Inc. is the latest company to venture into the world of self-driving vehicles.

.JPG;width=70;height=70;mode=crop)